Contents

Meaning Of Bond Index

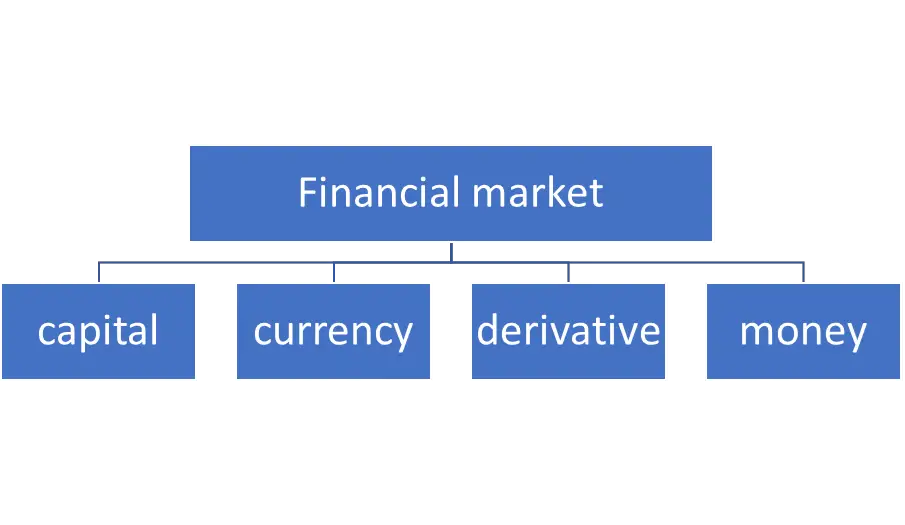

The financial market is the trading platform of different financial instruments according to the need of each entity or person. They mainly consist of four different markets.

- Capital market: They trade securities and debts.

- Currency market: They are also known as foreign exchange markets or FOREX.

- Derivative market: They engage in the trading of financial instruments derived from different assets.

- Money market: They mainly engage in arranging short-term finances.

In this article, we mainly discuss the debt instrument that is issued in the capital market

We have heard the word bond many times in our life. Bonds are usually associated with government securities. In the Indian scenario bond is a debt instrument which is issued by the government of India where the debt holder is entitled to repayment of the bond on a future maturity date along with the interest. Bonds are usually stated as the most secure form of financial instrument.

Overview of Bond Indices

Indices are the different measures in which the instruments traded in a financial market are valued. Indices play a vital role in understanding the current market condition of the stock or bond in which we are trading.

There are mainly two types of indices in the capital market. They are stock indices and bond indices. We are very much aware of the stock indices in the market. These indices are very commonly used in daily life. Nifty 50, and BSE Sensex are the most commonly heard indices in India. This only analyse the stock that is traded. What are the indices that analyse the trading of debt in the market? The answer is the bond index or bond market index. Every entity issue both stock and debt. The correct analysis of both is needed by an individual to earn a return from the investment made in the instrument. Let us now look deeper into what is the bond index.

Have you heard of bond indexing? Bond indexing or passive bond investing helps investors to build a better portfolio and generate a fixed income. The main takeaway from this concept is that the closer you analyse the bond market the more you can yield from it. These index funds usually own the securities that are listed in the index. People tend to invest in passive bonds because we can know the end yield of the bond.

Features of Bond Index

- The main characteristic of a bond index is that it consists of a large variety of bonds that are traded in the market and helps in benchmarking the performance of these bonds.

- The bond index includes all the necessary characteristics of the bond ranging from the issuer of the bond to the purpose of the bond.

- It usually contains the bonds of both global nature and domestic nature.

- They are usually controlled by a fund manager and they always closely understand the fluctuations of the market.

Role of Bond Index

- The first and utmost use of the bond index is that they remove the complexity of the bond market. They divide the bond market into segments and help the investor to understand the intake of each segment and invest accordingly.

- They also help in managing the risk associated with each bond that is provided in the market. They clearly state what is the overall percentage of risk associated with that particular bond.

- The bond index helps the investor invest in multiple bonds according to the risk intake of the different bonds listed.

- The market price of each bond is listed in the index, as the investor wishes to trade in the most sensible and alternatively better option, he may look into the indices and do accordingly.

- As they bridge the risk, they also highlight the expected return that is projected on the particular bond.

As we now discussed the role of these indices let us simply look into the different bond indices in the capital market:

Types of Bond Indices

There are different types of indices that are used in the capital market. The most commonly used bond index in India is the S&P BSE India Bond Index. They are the most preferable index that helps us to track down the performance of government-issued bonds and corporate bonds. There are several other bonds like Merrill Lynch Global Bond Index, Bloomberg Barclays Global Aggregate Bond Index, Citi World Broad Investment-Grade Bond Index (World BIG) etc.

These indices are based on where the bond is traded. There are different types of bond indices which depends upon the nature of the bonds ie whether they are globally issued or domestically issued. If the bond is globally issued the most prevalent bond index is the FTSE World Government Bond Index (WGBI) in which bonds from over 20 countries are constituted.

The Bloomberg Barclays US Aggregate Bond Index plays a vital role in the trading of bonds in the US.

The key takeaway from this is that the index depends on what type of bond you are trading in. Bond indices acts as a benchmark against which the performance of the bond fund can be measured.

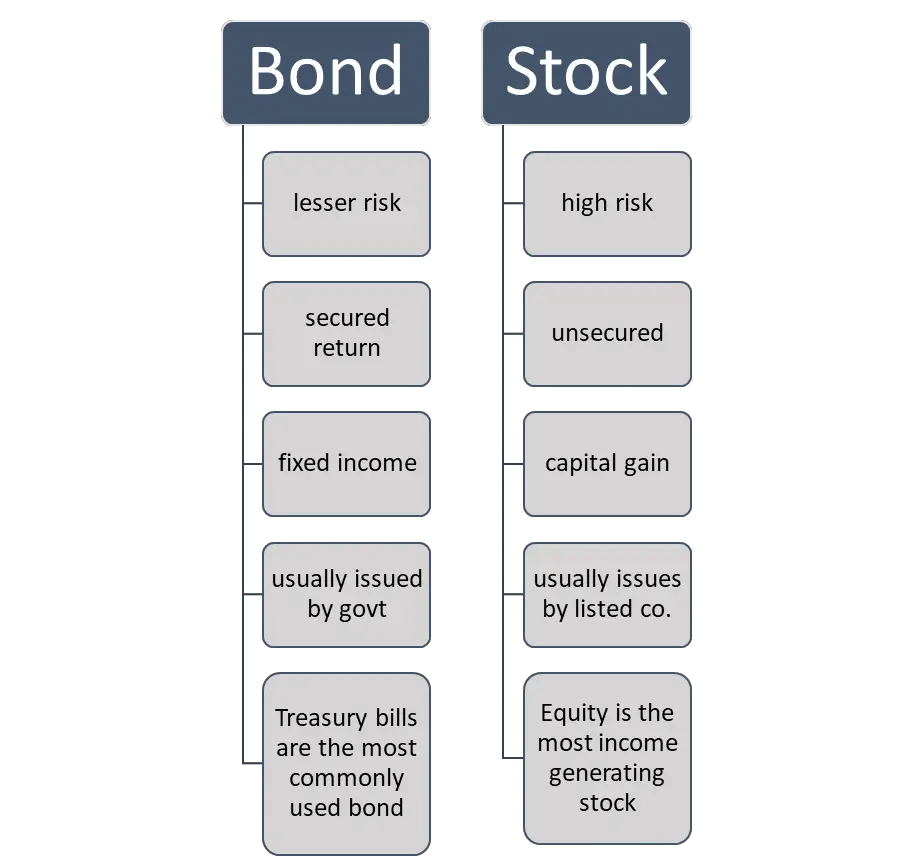

Bonds are the most traded in the capital market of a firm. The main reason for trading bonds is that they are safer than stocks as they generate a fixed income on investment.

Let us now a comparison between the bond index and the stock index.

From the above comparison, we can understand that a person expecting a fixed rate of return on his investment will always prefer bonds over stock. There lies the most important use of bond indices in the current scenario. People always want a way to increase their income without risking the loss of the income already generated. So people prefer the safest security option available to them. They then dig deep into that security to find the safest among those options. This is where the Bond index helps them to gauge the investment’s value and measure its value of it in the bond market.

Conclusion

From the above article, we understand that bond makes up the major share of the global capital market. So, an index to measure the bond is necessary to understand its value of the bond. Bond indices provide wide exposure to the different bonds that constitute the bond market. Bond indices help to reduce the complexity of understanding the nature of the bond.

Thus, we can conclude that the bond index helps in taking the correct decision regarding the investment in different types of bonds and understanding their value in the bond market.