Contents

Introduction to Additional Disclosure Statements

There have been countless financial scandals and frauds worldwide over the past few decades. Some of the well-known accounting scandals on a global scale include Enron, Worldcom, and Xerox. We have heard about the UTI scam, Coal-gate scandal, Harshad Mehta fraud, G2 scam, Says fraud, and the most recent one, PNB fraud, on a national level.

Both the volume and frequency of fraud are rising. Governments and organizations that set accounting and auditing standards are taking action globally to improve financial reporting as a result of the recent wave of rising fraudulent activities. The majority of these changes take the shape of more stringent disclosure guidelines for financial reporting. The Companies Act of 2013 required the creation of reports for the auditors, directors, corporate governance, business responsibility, etc. mandatory as parts of the annual report.

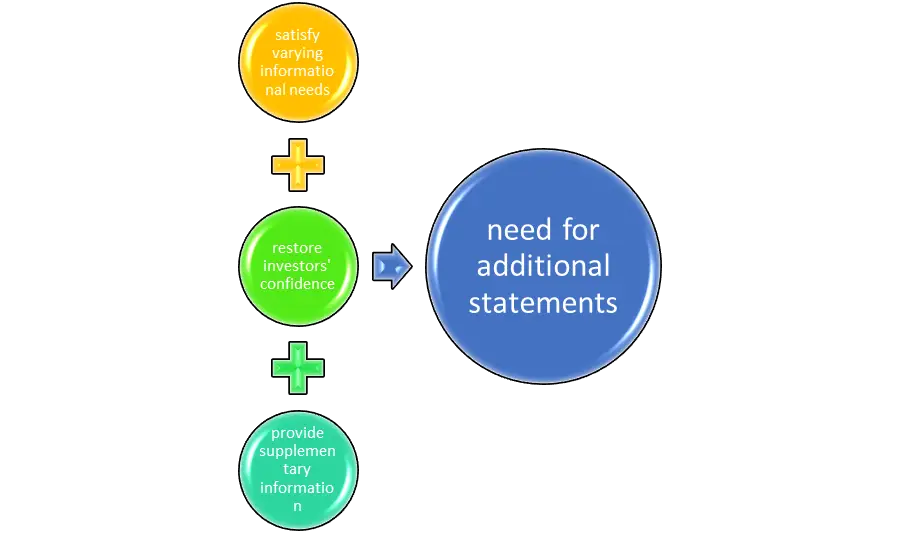

Need for Additional Disclosure Statements

Additional disclosure statements are needed by the individuals to satisfy their respective needs which can be listed as follows –

Satisfy varying informational needs of different user groups

To meet the diverse information needs of the various user groups, additional disclosure is necessary. Accountants find it challenging to defend a single reporting option against available competing alternatives due to their limited understanding of users’ preferences and behavior. It is therefore argued that more thorough disclosures or the simultaneous reporting of multiple options that meet certain logical criteria can help avoid these difficult decisions.

Restore the investors’ confidence in financial reporting

The regular scandals and frauds have severely damaged investors’ faith in financial reports. An effort has been made to regain investors’ faith in financial reporting by offering more disclosure statements. These statements contain crucial details on how the business is run, which can have a big influence on how different corporate stakeholders decide to proceed. The qualitative information in these statements, which is not included in financial accounts, has completely satisfied the stakeholders’ information needs. Along with the company’s current situation, future prospects, planning, and strategic focus areas are also alluded to. Since creditors and investors operate in an uncertain environment, better information’s function is to reduce this uncertainty and, as a result, change the beliefs they hold and the way they make decisions.

Provide supplementary information about future assumptions and estimates

Making specific future assumptions is one of the main drawbacks of the accounting process, and depending on these assumptions, different estimates are made concerning several expenses and benefits when reporting them in the financial statements. These assumptions could prove to be incorrect under actual future conditions, making calculations that rely on them unreliable. As a result, the stakeholders would be misled by the financial results based on these estimations. By providing additional information about these assumptions and estimations, the new disclosure requirements are intended to alleviate this type of constraint.

Meaning Of Auditor’s Report

An auditor’s report, which is a written letter from the auditor, expresses the auditor’s opinion regarding whether a company’s financial statements comply with generally accepted accounting principles (GAAP) and are free of material misstatement.

Typically, the independent and external audit report is made public together with the company’s annual report. The auditor’s report is essential because banks and creditors want an audit of a company’s financial records before lending to them.

However, a report from an auditor does not assess whether a company is a wise investment. Additionally, a review of the company’s earnings performance for the time period is not included in the audit report. Instead, the report just evaluates how trustworthy the financial statements are.

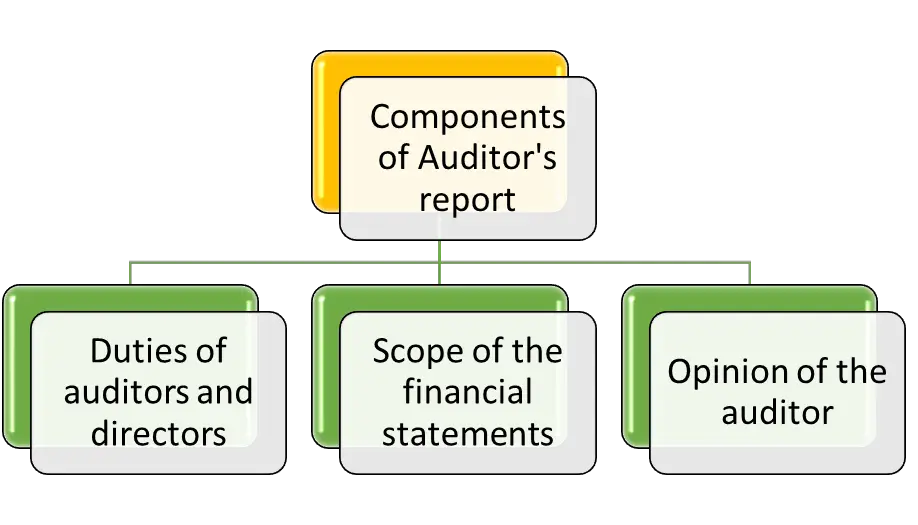

Components of Auditor’s report

The report basically consists of three paragraphs –

- The first paragraph of a report often contains a list of the duties of the auditor and directors.

- The scope is described in the second paragraph, which also states that a set of accepted accounting principles served as a guide.

- The opinion of the auditor is given in the third paragraph.

The results of a different audit on a different aspect of the entity’s operation may be disclosed to the investor in a separate paragraph. The third paragraph, which expresses the opinion, will catch the investor’s attention. The type of report that is published will depend on the auditor’s conclusions.

Directors’ Report

A company’s directors are required to prepare a directors’ report at the end of each fiscal year under Section 415 of the Companies Act 2006. This legislation is part of a broader trend toward increased corporate transparency. The information contained in the directors’ report assists shareholders in understanding:

- Whether or not the company’s finances are in good shape;

- Whether or not the company has the potential to expand and grow;

- How well the company performs within its market, as well as how well the market performs overall;

- How well the company adheres to financial regulations, accounting standards, and social responsibility obligations.

By knowing this information, shareholders can make more informed decisions and hold the company’s directors more accountable.

Components of Directors’ report

A directors’ report should always include the following information:

- Each director’s name who served during the reporting year;

- A synopsis of the firm’s trading activities;

- A synopsis of future prospects;

- The company’s primary activities and, if applicable, the primary activities of its subsidiaries;

- Dividend recommendations for the fiscal year;

- Any financial events that occurred after the balance sheet date, if these events could have an impact on the company’s finances;

- Significant changes to the company’s fixed assets.

Funds flow Statement

A Funds Flow Statement is a statement created to analyze the causes for changes in a company’s financial position between two balance sheets. It displays the influx and outflow of cash for a certain period, i.e. the sources and applications of funds. In other words, a Funds Flow Statement is created to explain changes in a company’s Working Capital Position. There are two sorts of fund inflows:

- Long-term funds obtained by the issuance of shares, debentures, or the sale of fixed assets

- Funds raised via operations

If a company’s Long Term Fund requirements are fulfilled only by Long Term Sources of Funds, the whole fund created from operations will be reflected by an increase in Working Capital. But working capital will decrease if funds from operations are insufficient to cover a shortfall in long-term funding requirements.

A profit and loss statement and two consecutive balance sheets of the corporation are required for a fund flow statement. An in-depth examination of two years’ worth of balance sheets reveals the real influx and outflow of cash from the previous fiscal year to the current fiscal year. Furthermore, it is a summary of assets, liabilities, and equity that affect working capital during the course of a fiscal year. It is also known as a ‘Statement of Funds Sources and Uses.’

A money flow statement serves two functions: accounting and investment. A money flow statement is commonly used by investors to evaluate an investment choice. The statement compares the inflows and outflows of funds over the course of a year. As a result, this comparative statement can aid in analyzing the movement of funds over two consecutive years.

Components of funds flow statement

In general, a fund flow statement provides details regarding the following:

- Sources of funding: This essentially reveals where the firm has obtained its funding. It can come from the owners or someone else.

- Application of funding: It demonstrates the company’s utilization of capital, concentrating mostly on current and fixed assets.