Contents

Meaning of Balance Sheet

Every company is bound to record the financial transactions that take place in their routine. Only if they record their transactions, it would be easy for them to analyse their financial position. To do this companies make use of the balance sheet.

Balance sheets are the end financial statement prepared at the closing date of the financial year which portrays the financial position of the company. It is based on this balance sheet the investors get their return. It is a statement showing the assets and liabilities of a company.

Even though the purpose served by preparing the balance sheet is the same for all companies there are differences in the way it is prepared. Further in this article, we are going to discuss the same.

Banking Company and Non-Banking Company

To understand this concept let us look into an example.

Ram wants to deposit Rs.100000 into a bank account. When he studies the market, he understands that there are mainly 2 types of financial institutions in the market and people make use of it interchangeably. He understands that both these types of institutions accept deposits and give him interest. At a glance, both looked the same but the security and offers provided by both are different. It is mainly because one is registered under the Indian Banking Regulation Act, 1949, and the other is registered as per the norms of the Companies Act, 2013. The one registered under the banking act is called a banking company and any other is known as a non-banking company. Ram would deposit his money in a bank if he needs protection on his deposit and if he is planning on depositing it as a demand deposit. Whereas if he does not want to avail the cheque facility and DD and is not interested in going through rigid legal procedures, he would go for a non-banking financial institution.

There are certain prudential norms for banking companies and a non-banking company that is to be kept in mind while preparing the final statement.

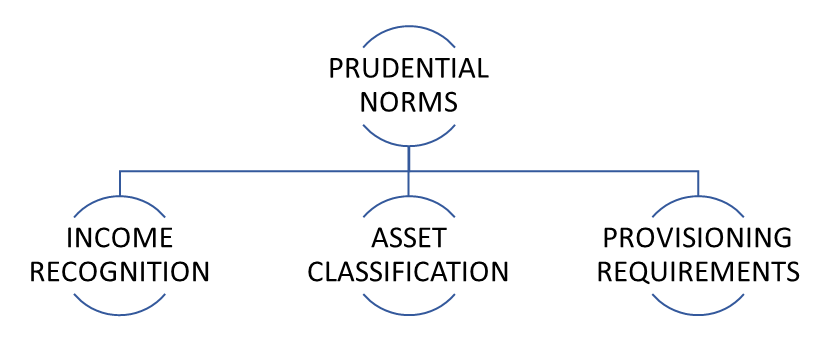

Let us look into the prudential norms of the banking company.

Prudential Norms of Banking Company

There are mainly 3 norms which should be kept in mind at the time of disclosure of the financial reports of the company. The following norms are based on the Master Circular DOR.No.STR.REC.55/21.04.048/2021-22 dated October 1, 2021, issued by the RBI. They are:

Income Recognition

- Income should be recognized based on recovery and not subject to any consideration.

- Interest on term deposits, National Savings Certificate, and Kisan Vikas Patra can be recognised as income. (Taking into consideration the margin)

- If income is not generated from an asset that income once recorded should be reversed.

These are the main norms regarding income recognition that is to be kept in mind. And most importantly any income arising from an NPA (Non-Performing Asset) should not be recognised as income even if it is government guaranteed.

Asset Classification

- They are mainly classified as special mention accounts and non-performing assets.

- Special mention accounts are the accounts which are not yet recognised as non-performing assets but it has an overdue against them.

- Non-performing assets the item that hasn’t generated income for a long period.

- The option to recover from the financial burden this NPA has created the lender sells or encashes the collateral securities given to them.

- Non-performing assets are again classified into 3 types and different provisions are written off against them.

- Sub-standard asset: The assets become non-performing for a period less than or equal to 12 months. These assets will incur some loss to the company.

- Doubtful assets: These assets have been in the category for 12 months and their recovery is highly questionable.

- Loss Assets: These assets have incurred loss but the company has not written off the full value because they hope there will be some salvage value for the same.’

Provisioning Norms

- Certain provisions are calculated to the assets to minimize the loss incurred. These provisions are based on the nature of repayment and overdue. The following table shows the provisioning requirements

| TYPE OF ASSET | MEANING | PROVISION |

| STANDARD ASSET | There is no default in payment. Only normal risk is carried along with them. | In the case of advances and loans 0.40% Farm Credit 0.25% |

| SUBSTANDARD ASSET | Identified as NPA for 12 months. | The usual provision is 15% An unsecured portion will have an additional 10% |

| DOUBTFUL ASSET UnsecuredSecured Up to 1 year1 to 3 yearsMore than 3 years | No realisable value There is a secured portion that might have a realisable value. | 100% 25% 40% 100% |

| LOSS ASSET | No chance of recovery | 100% |

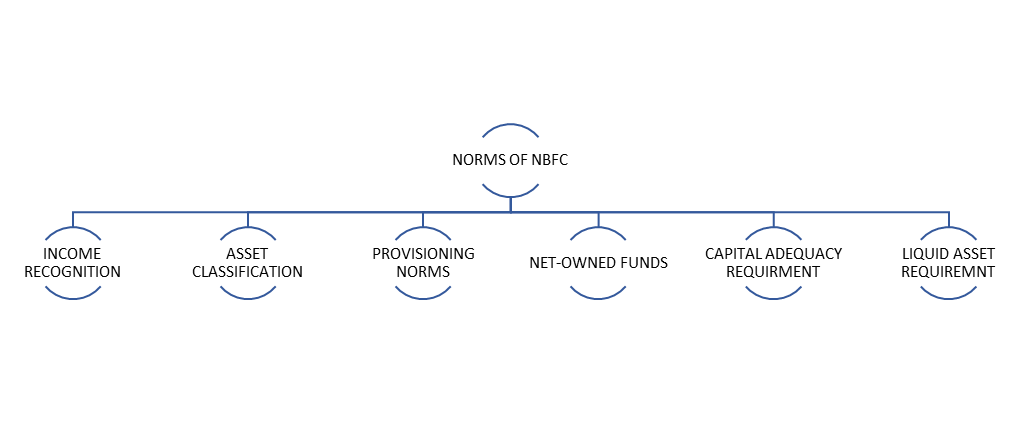

The above are the main prudential norms of a banking company. Non- Banking companies have 3 additional norms. Let us now discuss the norms of the main non-banking institution i.e. NBFC

Prudential Norms of Non-Banking Financial Institutions

- Net-Owned Funds: The total income generated by the NBFC excluding their investments is known as NOF. According to RBI at least 20% of their net owned fund(profit) is to be transferred to a reserve fund.

- Liquid Asset Requirements: The minimum liquid asset requirement of NBFC is 15% of the public deposits outstanding as of the last working day of the second preceding quarter. These are mainly maintained to meet the payment obligations towards the depositors.

- Capital adequacy requirement: The minimum capital adequacy ratio of the NBFCs is not less than 15% of aggregated risk-weighted assets.

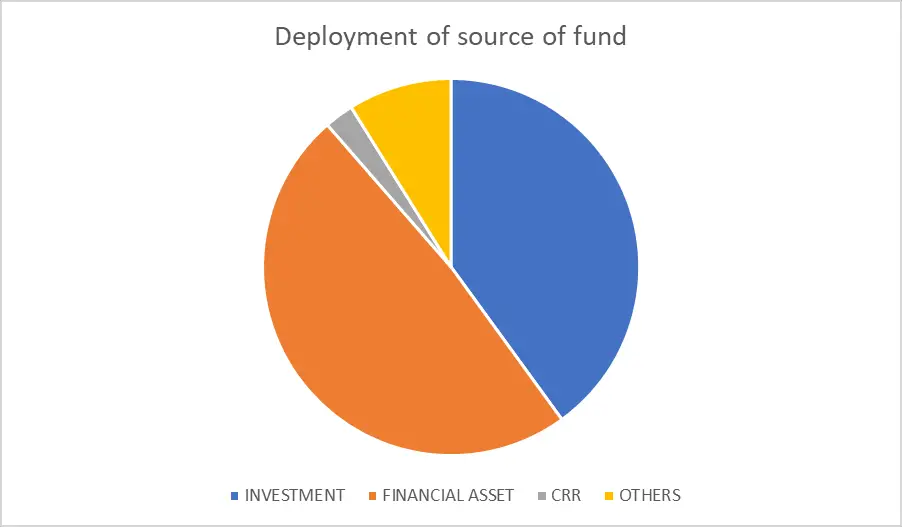

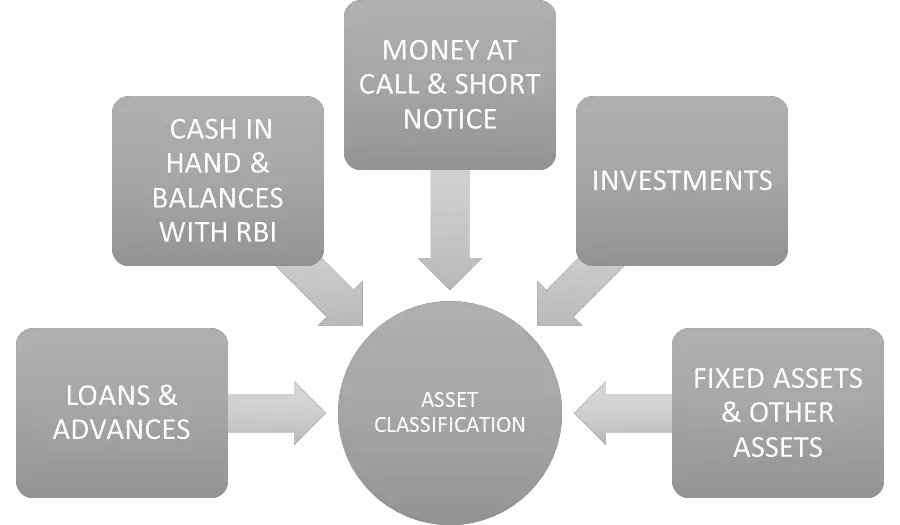

The next thing we are going to look into is the asset structure of a commercial bank.

We know that commercial banks raise 80% of the funds from deposits. And these deposits are deployed into different sources to generate income. This deployment decides the different factors that affect the asset structure of the company like liquidity, profitability, stability etc.

Cash in hand and balances with RBI

The cash kept by the bank to maintain liquidity is usually termed cash in hand. They do not usually possess any fetch but is important to maintain this in times of emergencies. The cash reserve or the balance that is to be kept with RBI is 5% based on the net demand and time liabilities. This rate keeps on fluctuating on the bases of the current economic scenario.

Money at Call and Short Notice

This is the method that banks adopt to generate income from the idle m money kept aside. They lend the money in the call market for usually 14 days. Usually, banks invest 4% of their funds in the call market or overnight market. They can also lend funds for a short period which is repayable at the notice of the bank.

Investments

We all are familiar with the term investment. Just like a normal person bank invests in funds to earn a profit. They invest in government-approved securities as well as capital market securities to keep up with the SLR and CRR requirements of the bank.

Loans and Advances

Commercial banks play the most vital role in mobilising the fund in the economy by borrowing from the surplus holder to lending to the needy. They help in maintaining an economic balance in the nation. The banks earn their main income from lending money. Due to the high rate of lending, the non-performing assets are increasing day by day. the risk included in lending is also increasing and banks are now in search of alternative ways to increase their revenue.

Fixed assets and other assets

These assets are mainly real assets which do not have much importance in the capital structure as banks always deal with financial assets.

Now let us look into the highlight of our article. From the above, it is clearly understood that there are different assets and liabilities for both banking and non-banking company. the norms on the basis on which the final statements are to be prepared are also different. We will have a comparative study on the balance sheet of Banking and Non-Banking company

Difference between the Balance Sheet of a Banking company and a Non-banking Company

| BASIS OF DIFFERENCE | BANKING COMPANY | NON-BANKING COMPANY |

| Format of balance sheet | According to the Indian Banking Regulation Act 1949 | According to schedule VI of the Indian Companies Act 2013 |

| Additional Info | Schedules are prepared to record the additional information. | Notes to accounts are prepared to record the workings. |

| Format | Capital and liabilities are followed by assets. | Equity and Liabilities followed by the assets |

| Asset components | Cash & Balance with RBI, Cash in hand, Money at call and short notice, Investment, Advances, Gross Block | Tangible Assets, Intangible Assets Non-Current Investment, Long Term Loans and Advances, Trade Receivable, Cash & Cash Equivalents, Short Term Loans and Advances etc |

| Liability | Total Share Capital, Reserves, Deposits, Borrowings, Other Liabilities & Provisions | Share Capital, Reserves & Surplus, Long Term Borrowings, Deferred tax liabilities, Other Long-Term Liabilities, Long term, provision, short-term Borrowings, Trade Payable |

From the above, it is clear that both the final statement is distinct in their way.

Conclusion

Now we have clearly understood what is the main difference between a banking company and a non-banking company. A company which borrows for lending is a banking company and any other company registered under the Companies Act is known as a non-banking company. The activities undertaken by both companies are different. Thus we can find the difference in preparing the final statement.