Contents

Meaning Capital Structure

Capital structure is a term related to the components of business capital used by it for financing its expenses. It involves the proper arrangement of owner funds and borrowed funds in right proportion for carrying out the operations in an efficient way towards achievement of goals.

Capital structure is also termed as debt-to-equity ratio. Debt come in the form of loans, debentures or issue of bond. Whereas, equity capital comprises of equity shares, preference shares and retained earnings. This arranged capital from various sources is used by business for funding day-to-day expenses, acquisitions, capital expenditures and various other types of investment. Every company aims to achieve optimal capital structure where there is low weighted average cost of capital and value of owners get maximized. However, calculation of optimal structure needs a strategical approach and analytical thinking.

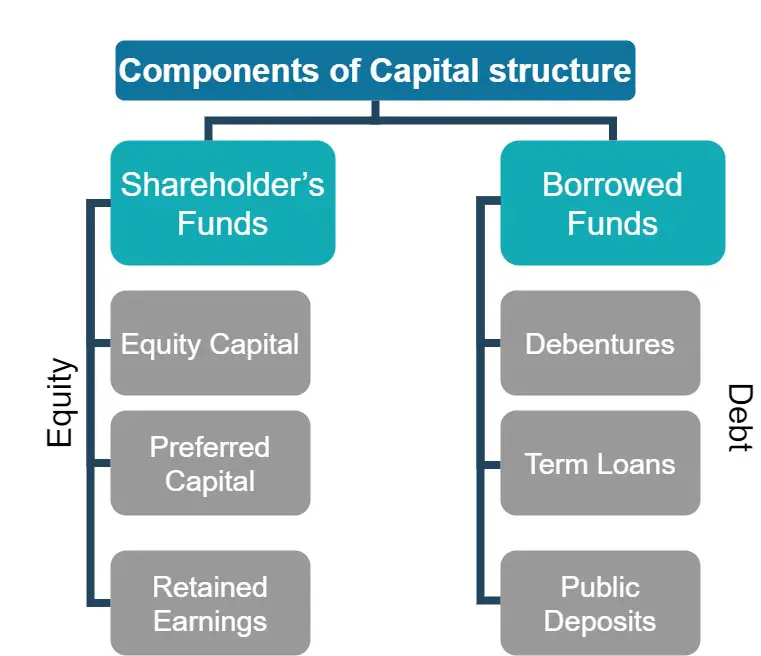

Components of Capital structure

Capital structure comprises of various sources from where the required funds is raised by company for meeting its long term capital needs. The different sources of funds taken into consideration by company are discussed below: –

Shareholder’s funds (Owner capital)

Shareholder funds is a funds that is contributed by owner of business and is also termed as ownership capital. It involves issuing shares for acquiring the funds or utilizing retained earnings for funding the expenses of company. Shareholder funds consists of three sources of funds which are:

- Equity Capital: Equity capital refers to the owner’s capital which is permanent in nature. The equity shares are issued which provides the ownership rights to shareholders. They are liable to receive the dividend as per the proportion of company’s profit. Equity shareholders are real risk bears whose liability is restricted to their amount of contribution.

- Preferred Capital: Preference shareholders are the one that carry preferential rights over equity shareholders in terms of dividend payment and capital repayment. These shareholder carries a right of getting a fixed rate of dividend. They are also owners of firm with limited voting rights and control over affairs of company. Preference shares are of many types like redeemable and non-redeemable, cumulative and non-cumulative, convertible and non-convertible preference shares.

- Retained Earnings: Retained earnings is a part of profit earned by company that is not distributed as dividend but is kept aside for reinvesting in business. It is also termed as self-financing or ploughing back of profits. It accumulates funds by keeping a part of business profits which are used for financing various activities thereby leading to growth and expansion of business.

Borrowed Funds

Borrowed funds refers to the capital borrowed from external sources in form of loans or credit. These are termed as outside liabilities of company which requires payment of fixed interest amount periodically. It leads to create burden on company, however it also benefits in the form of tax deduction. The different types of borrowed funds are:

- Debentures: Debentures is a debt instrument issued by company to public for raising funds. Debenture holders are the creditors of company and represent the borrowed capital. They carry a high rate of interest and are not bound by any collateral security.

- Term Loans: Term loans refer to the funds acquired by business from bank or other financial institutions at fixed or floating rate of interest. These loans are repaid back in installments and require collateral security to be provided by organization seeking loans. Companies with a strong financial status are easily able to acquire funds through this source.

- Public Deposits: Public Deposits refers to the deposit made by the general public, customers, employees and shareholders with the company for meeting its medium and long-term financial needs. It is the fund received in form of unsecured deposits rather than in shares and debentures form.

Factors determining the Capital Structure

Decisions related to capital structure of company is influenced by its both internal and external environment. The factors which influence the decisions of capital structure are as follows: –

- Nature of Business: Capital structure is largely influenced by nature of business activities. Business with stable level of income opt for debentures and preference shares. Whereas, those with non-assured income goes for internal resources of funds.

- Degree of Control: The degree of control that a company prefers to keep plays an effective role in deciding the capital structure. If owners want to keep a high degree of control over company affairs, then they will prefer debts over equity.

- Cost of Capital: Cost of capital is the cost involved in raising funds for business from various sources. While deciding the capital structure, the finance manager prefer such sources of funds involving low expenses which could enhance the value of shareholders.

Period of finance: The time period for which capital is needed by business is considered while taking capital structure decisions. If the funds are needed for short or medium term, then company will go for debentures and preference shares. In case of long-term funds, equity funds are mostly preferred. - Debt-Equity Ratio: Preference for a debt-equity ratio by company determine its capital structure. If a company aims to maintain a low debt-to-equity ratio, then it will prefer debt funds over the equity funds which do not leads to dilution of ownership and is a cheap source of funds.

- Size of Company: The size of company greatly influences the proportion of debt and equity in capital structure. Large companies are considered more reliable and can easily raise funds through the issue of debenture or taking loans. Whereas small companies face difficulty in raising debt capital, therefore are dependent on equity capital and retained earnings.

- Need of the Investors: The needs of investors should be considered while taking capital structure decisions. Different investors carry distinct psychology that affects their investment decisions. An investor of poor class looks for smaller denomination investments that is equity or preference shares. Whereas, financially sound investors will look for investments of higher denominations such as debentures.

- Tax rates: Tax rates play a major role in determining the capital structure. In case of high corporate taxes, companies prefer debt capital because interest paid on debt is allowed as a deduction while computing a tax liability. Dividend paid on equity and preference share capital are not allowed as tax deduction.

Importance of Capital Structure

- Maximization of Return: Capital structure plays an efficient role in maximizing the overall return of company. A properly designed capital structure raises the earnings per share which ultimately maximizes the overall return of equity shareholders.

- Minimizes the Financial Risk: Every business aims to minimizes its overall financial risk involved in its operations. Capital structure decisions assist managers in attaining a balanced proportion of debt and equity that results in reducing the risk.

- Enhances Firm Value: Every investor prefers to invest in such companies having a sound capital structure. Proper capital structure increases the market price of company’s shares and securities which in turn raises the firm value.

- Provides Flexibility: Capital structure provides flexibility in adjusting the debt capital as per the business conditions. It enables an easy contraction or expansion of debt capital as per the conditions and strategies of firm.

- Efficient Utilization of Funds: Proper capital structure pays attention on fuller utilization of available funds. A well designed capital structure properly determines the firm’s financial requirements and accordingly acquire these funds from various sources for attaining better efficiency.

- Tax planning Tool: Capital structure acts a planning tool for deciding the tax liability of company. It provides a tax deduction facility for firms opting debt funds thereby enables them in saving their profits and reducing the cost of borrowing.

Planning of Capital Structure

Proper planning of capital structure requires proper analysis of both short-term and long-term financial requirements of company. There are various factors which needs to be considered by management for deciding a balance proportion of debt and equity. Some of these factors are stability of earnings, amount of financial leverage a company can bear, ability of company to pay off its debts out of the profit earned etc.

Recapitalization of Capital Structure

Recapitalization of capital structure means redesigning the capital structure of company in accordance with business needs and changing conditions. It means changing the proportion of debt and equity from time to time to suit the requirements.

The term recapitalization has different meaning for different firms. The first recapitalization option is increasing the debt and decreasing equity. It is done by issuing more of debt and repurchasing of equity. This option is suitable for companies willing to retain a high degree of control with themselves.

Second option involves issuing debts and using the funds acquired for paying off one-time dividend to equity shareholders. It results in reduction in equity shares value for future investors.

Third option is more suitable for companies that are unstable having high debt liabilities. They issue new shares for acquiring funds for repaying their debt.