Contents

Meaning of Corporate Accounting

In the corporate world, various companies are functioning. These companies have their shareholders, who are the owners of the company, debenture holders who are the lenders of the company, creditors, bank loans and bank overdrafts which are the short-term liabilities, cash and cash equivalents, investments, fixed assets, goodwill and debtors which are the assets. Apart from this, the company has many expenses and income both short term as well as long-term. So, it becomes difficult for a company to handle all these without a proper system governing rules and regulations for their treatment.

So the concept of corporate accounting emerged as a solution to it. Corporate accounting tells a company what should be the treatment of assets and liabilities, what are the obligations of a company towards its shareholders and long-term borrowings and what are the treatment of the company’s expenses and income. Apart from this, the concept of corporate accounting simplified the preparation of financial statements of a company, principles regarding company accounting policies and rules that govern the entire accounting system.

What is corporate accounting?

Corporate accounting can be well defined as a branch of accounting that deals with the accounting of companies. It is an important branch that lays down all the aspects of a company’s accounting, such as how financial statements should be prepared, what principles should be followed while making a financial statement, how to treat cash and non-cash transactions, and many more. Apart from this, it includes various tasks, such as:

- Preparation of accounts

- Preparation of cash flow statements

- Analyses of a financial report

- Accounting for amalgamation and absorption

- The consolidated balance sheet of the company, etc.

Corporate accounting is responsible for ensuring that all the financial activities of a company are accurate, informative, and in compliance with the law. It also ensures that all the activities taken are by the organizational policies.

Importance of Corporate Accounting

Corporate accounting is crucial to any company as the entire financial system of a company is based on the principles, rules, guidelines, procedures and policies of corporate accounting. Corporate accounting helps companies to prepare their financial statements and always keep them accurate and up to date. These reports further help a company to identify its present financial position and to ascertain its future growth perspectives.

Aside from this, significance of corporate accounting includes the following:

- It provides information related to historical and present financial activities.

- It reflects the position of assets and liabilities of a company.

- It reflects useful information such as a company’s financial position, its ability to meet its financial obligations, its growth perspectives, etc, to outsiders such as investors.

- It ensures that all the activities comply with the law.

- It generates reports for the management for decision-making.

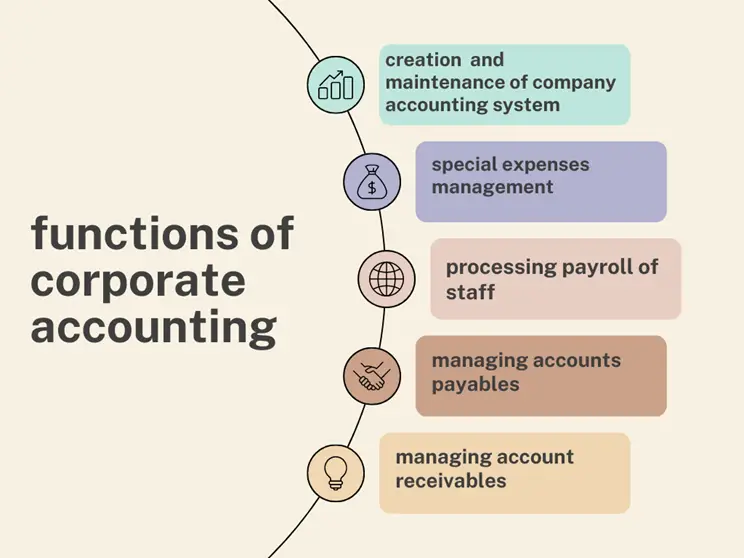

Functions of Corporate Accounting

The following five are the main functions or activities that are performed under corporate accounting.

Creation and maintenance of the company accounting system

The main function of corporate accounting is to create and maintain the company accounting system. There are various elements in a company such as assets, liabilities, income, expenses, equity, debt, interest, dividend and many others which need to be assessed and recorded carefully. A corporate accounting system lays down procedures and accounting treatment of various elements of a company. Also, it lays down the rules and regulations regarding the discharge of expenses and utilization of income. It makes sure that the overall accounting system of a company works smoothly and efficiently.

Special expenses management

A company always requires special reserve or balance with it to stay compliant with business regulations, unforeseen challenges and operating expenses. Corporate accounting ensures that a company should have the necessary balance with it to meet the expenses related to taxes, wages, employee benefit schemes, distribution for retirement, bonuses, and any unforeseen challenges that occur. A good corporate accounting system always takes care of these expenses and ensures funds available to meet them.

Processing payroll of staff

The calculation of staff salaries, bonuses, and benefit schemes is also a part of corporate accounting. In this task, corporate accounting calculates the salaries payable to an employee. Also, it keeps a record of employees’ contributions to the company to calculate their bonuses and other benefits payable to them.

Managing account payables

Corporate accounting handles receives and processes all the invoices that come into the company. Then, it is asserted, what are the amounts payable to the contractors, suppliers, and treatment of other expenses incurred in the process. All the balance or amount payable to the creditors is paid via electronic means, i.e., directly into the bank account. Apart from this, corporate accounting also manages payments of loans, taxes, premises, maintenance costs, etc.

Managing account receivables

Apart from handling accounts payables, corporate accounting also takes on the responsibility of managing all the accounts receivables. This is the process of handling the payment received from the client for the fulfilment of their needs or requirements. Corporate accounting handles the cash receivables and uses them to meet the financial needs of the company. Also, it handles cases of defaults where the client is unable to make payments.

Role of Corporate Accounting

Corporate accounting is a modern approach in the corporate world. It plays a crucial role for the insiders, such as employees, stakeholders, and management officials, as well as for the outsiders, such as investors and the general public. To insiders, it reflects the workings of the company, its strengths and areas that need attention, how capable management is in handling situations, how to increase the profits of the company, and how to minimize the losses and risks. It assists outsiders in determining whether the company is a safe and secure one in which to invest money, what the company’s financial position is, and whether the company is profitable or losing money. Thus, it helps both interested groups in taking further decisions.

Apart from this, it plays an important role in the entire accounting system of the company. Or, to put it another way, it lays the groundwork for corporate accounting, which is its primary role.

Conclusion

Corporate accounting is an important branch for the company, without which its accounting system cannot run properly. It provides a framework for the company within which it has to discharge its duties and prepare important accounts. Furthermore, it assists a company in preparing financial statements and helps the company in systematic record keeping, analyzing financial statements, decision making, managing expenses, and managing accounts payable and receivable. It plays a vital role in the growth and decision-making of the company as well.