Contents

Meaning of Financial Intermediaries

Financial intermediaries and financial assets are two different segments or words that are used to reflect the working of a financial market. Financial intermediaries are those which act as a platform where two financial parties, say lender and borrower, meet each other. On the other hand, a financial asset is a term used to represent the document, instrument or sources in which both these parties deal and form an obligation and binding relationship.

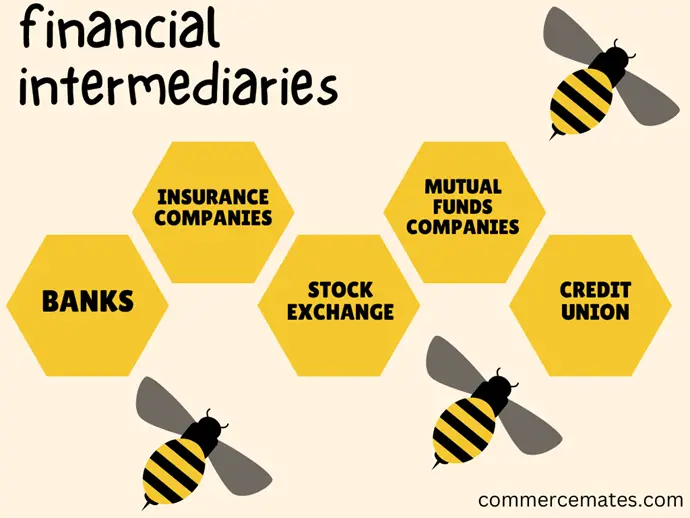

Who are Financial Intermediaries?

Financial intermediaries refer to the financial entities or institution that acts as an intermediary between two parties. A financial intermediary acts as a middleman between the financial transactions of two different parties. Financial intermediaries may be a bank or a non-Bank institution which is owned or run by the government or any other private entity. There are various financial intermediaries such as non-banking financial companies, mutual fund companies, insurance companies, financial advisors and many more.

Role of Financial Intermediaries

Financial intermediaries are of crucial importance in an economy. They support the flow of income or money in the economy and thus boost economic growth. They act as a bridge between two different parties and enable the smooth flow of money between them. Apart from acting as an intermediary they also support other productive functions such as providing loans, mortgages, investment vehicles, leasing and insurance.

Some of the crucial rules that are played by financial intermediaries are:

- Linking a houseful to the financial market.

- Safeguarding and protecting customers’ money.

- Providing financial advisory services, financial information and other related information.

- Helping various businesses to achieve economies of scale.

- Helping corporate entities to enhance their capital structure by providing a proper mix of equity and debt.

- Stimulating and enhancing the economic development of the country.

Examples of Financial Intermediaries

Various financial intermediaries are working in their entire capacity to boost development in the corporate sector and the economy. Some of them are:

Banks

Banks are one great example of financial intermediaries that utilize the deposit made by the client by way of lending it to the entity in need. The interest earned from lending is the bank’s most important source of income. A bank also offers various other services such as insurance for deposits, credit cards, etc.

Insurance companies

Insurance companies are those companies that provide insurance or safeguards for life, home, fire, and any other misfortunes. The main function of an insurance company is to protect its customers from casualties and uncertain future. These companies invite customers to invest in various policies and the money collected by them is invested in various other investments or bonds. The huge profits made from such investments become a major source of income for insurance companies. This income is further used to exploit more opportunities.

Stock exchange

The stock exchange is a market for financial instruments such as shares. Here, the buyer and seller of securities interact with each other and form a contract through the purchase or sale of securities. It acts as an intermediary, bridging the gap between companies in need of funding and investors with funds to invest.

Mutual funds companies

A mutual fund company is a company that collects funds in the form of fixed deposits from various users to invest them in different financial assets, thereby earning a huge return on their investment. These returns are used to pay interest to the users, meet other expenses, and explore other opportunities.

Credit unions

Credit unions are non-profit organizations that are owned and managed by their members. It works similarly to a bank; however, it is different from a bank in various other aspects. Such a credit union provides better savings rates and offers loans to its members at a comparatively low rate.

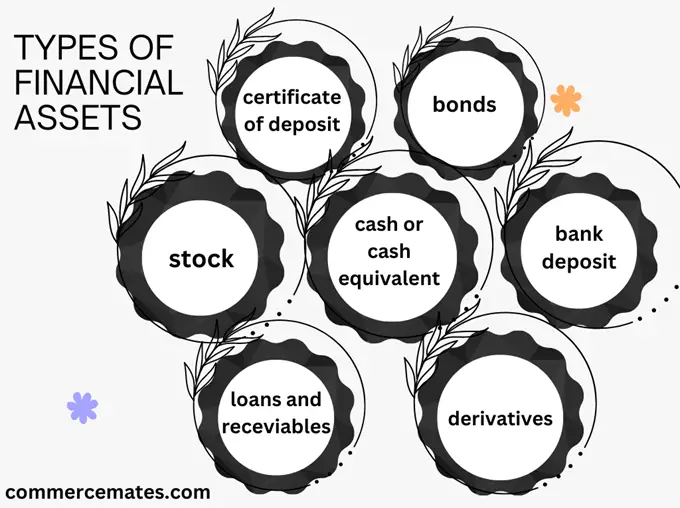

What are Financial Assets?

A financial asset is an asset presented in liquid form that gets its value from a contractual right or ownership claim. In simple words, a financial asset is an instrument or security that can be easily converted into cash. They are the most commonly used financial instruments that are always present in instrumental or documentary form and can be converted into cash or cash equivalents on demand. A financial asset is a legal contract or a legal claim that is subject to a return obligation at a predefined maturity value or on demand.

Types of Financial Assets

Many types of financial assets are used in the process of borrowing and lending. Following are some of the commonly used financial assets.

Certificate of deposit – A certificate of deposit represents a legal and binding agreement between an investor and a banking company. This document represents a certain amount that is deposited in the bank in return for a guaranteed interest rate.

Bonds – Bonds are usefully called a “debt instrument” that is offered by corporate entities or government entities to raise funds for various projects. This is a legal document that states that the money lent by the borrower should be paid back on its maturity date. Aside from this, bonds carry a specific rate of interest that has to be paid regularly.

Stock – Stocks are often regarded as one financial asset that has no maturity date. Stock investment is particularly referred to as “participation in the ownership of a company.” Its maturity date arrives only at the time of winding up a company. Apart from this, it can be converted into cash by selling it to another entity or person.

Cash or cash equivalent – Cash or cash equivalents are the reserved or monetary amount that is kept with the organization to meet its day-to-day requirements or any payment arising due to an uncertain event.

Bank deposits – Bank deposits are the cash reserves that an organization or entity keeps with the bank in the form of savings. These deposits are classified into two types: those that are payable on demand and those that are held with the bank for a set period (fixed deposits).

Loans and receivables – Loans or receivables are those assets that contain a fixed charge or fixed repayment obligations.

Derivatives – A derivative is particularly a security held with a price that is dependent upon one or more underlying assets. It is a contract based on assets between two or more parties.