Contents

What is Sources of Funds?

Funds are the most important factor that helps a business to sustain itself in the economy. Funds are essential from the moment we think of starting a business till the moment of liquidation. When an idea is generated in the minds of an entrepreneur the most important factor lies in where he can cash the idea which is generated. On the contrary when a person thinks of winding up his business, in that case also he needs funds to settle the stakeholders of the company.

We understand that business needs a lot of funds. But where do these firms find all these funds? What are the different ways to pool these funds?

In this article, we will talk about what are the different sources of funds through which business raise their capital and meet the financial requirements of the enterprise.

Meaning Of Source Of Funds

Sources of funds or financing are the ways through which the company raises their capital requirements. Sources can be chosen according to the requirements, basically whether long-term or short-term. The source of funds defines the nature of the finance raised. Every business has two types of financial requirements. They are

- Fixed capital requirements:

They are required to purchase the fixed assets of the company. Usually, the fixed capital requirements raise occasionally and mainly during the start of the financial year. The fixed capital requirements of a company are huge amounts.

- Working capital requirements:

This is the finance that is required to meet the day-to-day operations of a firm. They are usually financed for less than a year. The requirements of finance depend on the size of the firm.

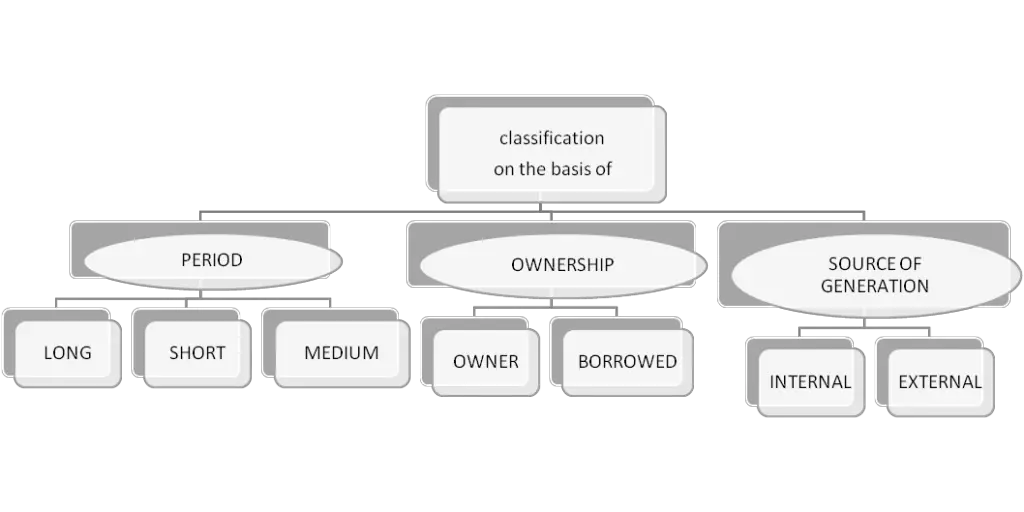

To meet these requirements, let us see how are these sources classified

Types of Sources of Funds

On the basis of period:

Under this classification, sources are classified based on the period for which it is pooled. It can be also referred to as the difference in the fixed capital or working capital requirements which is met by funds raised through this. the 3 types of sources are;

- Long-term sources:

- These are mainly raised for more than 5 years.

- This is to meet the fixed capital requirements of the firm

- This includes bank loans, venture capital (for start-ups) etc

- Medium-term sources:

- This meets the requirements of the firm on a stretch basis.

- This is usually taken into consideration for a period of 1 to 5 years.

- Some of the commonly used middle-term sources are public deposits, lease financing etc.

- Short-term sources:

- Funds that are essential for the day-to-day working of the business are raised through these sources.

- They are usually pooled for less than a year.

- Commercial paper is the most commonly used instrument here.

On the basis of ownership:

This is classified according to the ownership of the persons who provide the funds. In other words, who has supplied the fund? This can be widely classified into 2, they are;

- Owner’s fund:

- This is the fund raised by the owners of the firm.

- These are the Owings of the people who have ownership rights in the firm.

- The main examples of owner’s funds are equity share capital and retained earnings.

- They not only invest the amount but also reinvest the earnings for the growth of the firm.

- The funds raised through this source are not liable for repayment.

- Borrowed funds:

- This is also known as debt financing.

- In this case, the fund is raised through borrowings from third parties and the firm is liable to pay back the amount on maturity or at a prescribed date.

- There is a fixed interest chargeable on these types of the source which the company is liable to pay irrespective of its financial position.

- Debentures and bonds are the most common debt financing availed by the majority of the firm.

On the basis of generation:

The sources through which the funds are generated are very important for the firm. There should always be a balance between the funds raised through different sources. The 2 types of sources are:

- External sources:

- The sources outside the organisation are referred to as external sources.

- In case of large fund requirements, the company has to seek the help of outsiders to raise these funds.

- These funds come with interest and have to be repaid within a certain period.

- Preference shares and factoring are different types of funds raised through external sources.

- Internal sources:

- These are the funds which are ploughed back from the earnings of the firm.

- This fund can be limited in amount but does not possess the burden of repayment on the firm

- They are generated from the business and used in the business.

- Retained earnings are the most commonly stated internal source of funds in an organisation.

There are different types of sources like venture capital, lease financing, and crowdfunding which are the upcoming future source of financing.

But what is the use of this sourcing? Can a firm sustain itself without using different sources of business?

Benefits of Sources of Funds

Each source of funds possesses its advantage over the other. According to financial theories, it is said that a firm with a perfect mixture of both debt and equity will have a higher chance of financial stability and marketability than firms with just any one source. We can understand that the firms must identify the financial need and pool the funds accordingly. The major benefits of the sources are listed below according to the characteristics possessed by them:

Benefits of owned funds:

- Most convenient and has no worries about repayment.

- Does not lead the company into debt.

Benefits of borrowed funds:

- Large amounts will be easily assessable

- Repayment can be done without giving the ownership credits.

- In case of a money shortage, there is always an option of borrowing.

These are the most simple and understandable benefits of the funding. We can also say that:

- Sources of funds help us to explore new market opportunities which are available to the firm as there is access to versatile schemes of funds.

- Funds are available to all firms irrespective of the size of the business.

- There is no need for capital investment for short-term projects. For example, we can lease a property for some time and cancel the lease after our desired output. Whereas if we cannot lease, we have options even to hire. There are several alternatives available.

Sources of funds help the enterprise to meet its requirements. Without the different sources, it will be difficult to meet the capital requirements of the firm. A business can be successful only if there are adequate funds for smooth functioning.

Conclusion

A firm needs funds for smooth functioning. They raise these funds from different sources available to them. there should be a proper mixture of both debt and equity for the firm to sustain itself in the market. Any firm needs funds and they should choose the appropriate source to meet their funds’ requirements. So we can conclude that the appropriate pooling of funds from the correct source results in the increased financial position of the firm.