When there is no competition in the stock market the buyers and sellers do not choose. They are forced to choose the only option available to them. In the current era, people prefer to choose among the best and they do not like to have just a single option. They want a market where they can trade the stocks according to their preference. To overcome this limitation of a centralized market decentralized market was introduced. A decentralized market is a market that is ideal for traders and investors to yield high profits from trading. As investors prefer a wide range of choices decentralized market has become the preferable option for them.

Contents

Meaning of Decentralized Market

A decentralized market emerged mainly because of the wide use of internet among the traders. Through a decentralized market, traders can interact and exchange securities directly without going through the central market. The latest example of a decentralized market is the blockchain system which uses cryptocurrency.

In a decentralized market, the traders have the choice of trading with different parties and have a competitive advantage. The buyers and sellers can choose the best price quoted and can directly connect with the parties through the peer-to-peer network.

Unlike traditional markets, a decentralized market quotes prices on a real-time basis without the need for a physical presence. All the transactions are technologically encrypted and provide high security to the traders.

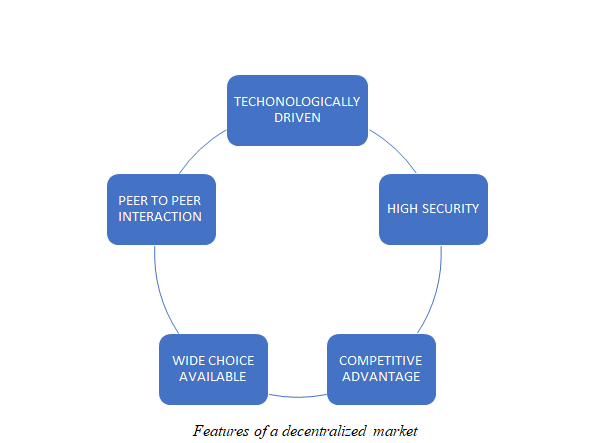

Features of decentralized market

- Every trade undertaken is computer-based and technologically driven. These transactions thus provide high anonymity and security to the investors.

- The sellers and buyers can contact each other directly and talk about the trade that is going to be undertaken by them.

- As there is a wide range of stocks traded there is high competition that gives the buyers the choice to choose among the best of the best.

The decentralized market has numerous benefits in the current scenario. Trader behavior is one of the main factors that influenced the working of the decentralized market. Let us now look into the different benefits of the decentralized market.

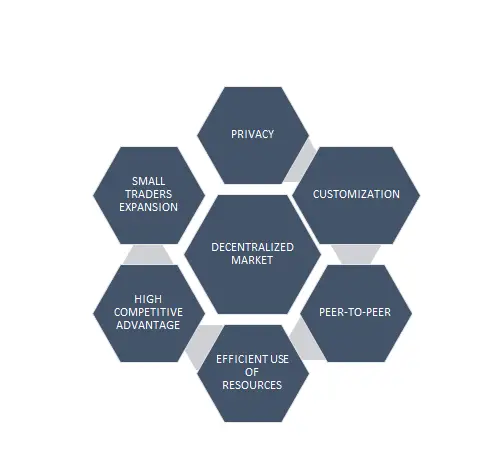

Benefits of a Decentralized Market

- There is high anonymity in the transactions that take place. as everything is web-based without physical interaction, we can make sure that the transactions are complete.

- There is direct contact between the parties to the contract. This eliminates the role of the intermediary.

- The buyer and seller will have control over the transaction. They are directly linked in the contract and it is they who decide what should happen in the transaction that takes place.

- The fees in the decentralized market are re-distributed to the liquidity provider who controls the smooth functioning of the market.

- Decentralization is more efficient in decision-making and is put to greater use.

- The lack of intermediaries results in lower cost and the absence of a regulatory body give the traders complete freedom over the transactions.

- A decentralized market is suitable even for small traders as they can directly deal with the buyers and make transactions without any intermediary and with even less cost. Only the fee of the system is payable by them.

- There is a highly competitive advantage because brands from all over the world transact under one head and there are chances of international business the local brands can even collaborate with the international brands and this acts as a base for the globalization of the business.

- There is the customization of needs and efficient use of resources as the sellers are in direct contact with the buyers and alter the transaction according to the convenience of the customer.

These are some of the main advantages of the decentralized market which emerged recently through the innovation of technology and the customer’s need for privacy.

Even though a decentralized market is widely used and preferred by most traders there as certain cons for the same;

- As there is no intermediary the parties to the contract themselves have to learn about the transaction. If the parties do not have a clear-cut idea regarding the transaction the investment may be subject to high risk.

- In the absence of liquidity providers, the whole working can be disturbed.

- The people who do not have much idea about technology can be conned in the decentralized market. As there is no regulatory system there is a higher chance of risk of loss.

Apart from the above few limitations, the decentralized market is the market type that is still preferred by mostly all parties.

Examples of decentralized market

There are many transactions in the current scenario that is carried out through a decentralized market. Their main transactions are listed below. This will give you a complete idea of how the working of a decentralized market takes place.

- Forex Market: The most eminent example is the foreign exchange market where investors buy and sell securities without going to a physical location.

- Real estate: In real estate buyers and sellers complete their transactions without the involvement of intermediaries.

Conclusion

A decentralized market is the most innovative market that emerged due to the upgradation of technology. This market reduces the cost of intermediaries and their elimination of them increases the privacy in the transactions. The most important factor is that it is a peer-to-peer transaction where buyers and sellers come directly in contact and choose among the wide range of options available to them.