Contents

Meaning of Financial Services

Financial services refer to economic services provided by various financial institutions that deal with the management of money. It is an intangible product of financial markets like loans, insurance, stocks, credit card, etc. Financial services are products of institutions such as banking firms, insurance companies, investment funds, credit unions, brokerage firms, and consumer finance companies.

Nature of Financial Services

- Customer Oriented: Financial services are customer-focused services that are offered as per the requirements of customers. Financial institutions properly study customer needs before designing and offering such services. They are meant to fulfill the specific needs of a customer which differs from person to person.

- Intangibility: These services are intangible which makes their marketing a challenging task for financial institutions. Such institutions need to focus on building their brand image by providing innovative and quality products to customers. Firms enjoying better credibility in market are easily able to sell off their products.

- Inseparable: Financial services are produced and delivered at the same time simultaneously. These services are inseparable and can’t be stored in advance. Here production and supply function both occurs at the same time.

- Manages Fund: Financial services are specialized at managing funds of people. These services enable peoples in allocating their idle lying funds into useful means for earning revenues. Financial services provide various means to people for converting their savings into investment.

- Financial Intermediation: These services does the work of financial intermediation as it brings together the lender and borrower. Financial services mobilize the funds of people who are having enough of it and made it available to the one who are in need of it.

- Market Based: Financial services are market based which changes as per the changing conditions. It is a dynamic activity which varies as per the variations in socio-economic environment and varying needs of customers.

- Distributes Risk: Risk distribution is the key feature offered by financial services. These services transfer the risk of an individual not willing to take among different persons who all are willing to bear it. Financial institutions diversify the risk and secure people against damages by providing them various insurance policies.

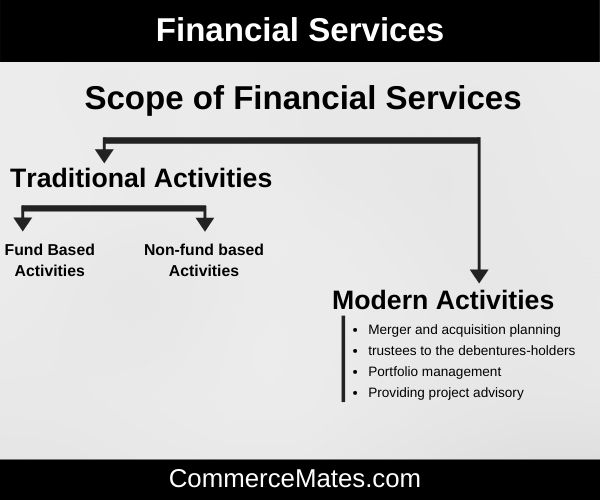

Scope of Financial Services

Financial services consist of wide range of activities which are broadly classified into 2: –

- Traditional Activities.

- Modern Activities.

Traditional Activities

Financial intermediaries have been offering a large range of services traditionally

Related to capital and money market activities. These services are classified into 2 groups: – Fund based activities and Non-fund based activities.

Fund Based Activities.

Fund based activities comprises of activities which are concerned with acquiring funds and assets for clients. Different services covered under fund based activities are: Primary and secondary market activities, dealing in money market instruments, foreign exchange market activities and involving in hire purchase, venture capital, equipment leasing etc.

Non-fund based Activities.

These services are provided by financial intermediaries on non-fund basis and are called fees-based services. Non-fund bases activities are specialized services offered by financial institutions to customers in exchange for fees, commission, dividend and brokerage. This comprises of services such as Portfolio management, issue management, stock broking, merchant banking, credit rating, debt and capital reconstructing, bank guarantee etc.

Modern activities

Financial intermediaries beside the traditional services offers a wide range of financial services at present. These activities are mostly in the category of non-fund based activities.

Few of the modern activities are listed below: –

- Merger and acquisition planning and helping with their smooth carry out.

- Providing guidance in capital reconstructing to corporate customers.

- Assisting in rehabilitation and reconstruction of sick companies.

- Portfolio management of large public sector corporations.

- Providing recommendations in management style and structure for attaining better results.

- Acting as trustees to the debentures-holders.

- Providing project advisory services ranging from project preparation to capital raising.