Contents

Meaning of Derivatives

Derivatives are financial instruments used for trading in the market whose value is dependent upon one or more underlying assets. It is a security that derived its value from underlying assets such as stocks, currencies, commodities, precious metals, stock indices, etc. Derivatives represent a contract that is entered into by two or more parties.

This contract is regarding the money payments and sell/purchase of assets between the parties. There are certain conditions which are attached to this contract while entering into such as contractual obligations of parties, date of maturity, notional amount and resulting values of underlying instruments. Derivative instruments are mainly used for hedging the risk or earning profit through speculation on value of underlying security.

These instruments are either traded over the counter or via an exchange. Over-the-counter (OTC) derivatives are one which is traded privately and without any intermediary whereas exchange-traded derivatives are traded via specialized exchanges such as Bombay stock exchange. Futures, forwards, options and swaps are four main types of derivative instruments.

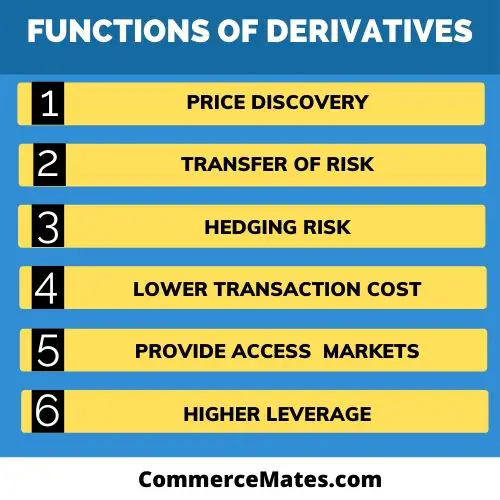

Functions of Derivatives

Price Discovery

Derivative contract helps in determining the prices of the underlying assets. Future and forward contract prices are used in determining the future spot prices for the commodity. This way it is beneficial in discovering the prices for underlying assets.

Transfer of Risk

Derivatives are used for transferring the risk from one party to another that is a buyer of a derivative product to the seller. It is an effective risk management tool that transfers the risk from those having a low-risk appetite to those having a high-risk appetite.

Hedging Risk

It helps in hedging risk against unfavorable price movements of an underlying asset. By entering into a forward contract, the buyer and seller agrees to complete the deal at a pre-decided price at some specific date in the future. Any unexpected price hikes or drop will not influence the contract value, thereby providing protection against these types of risks.

Lower Transaction Cost

The cost of trading in derivative instruments is quite low as compared to other segments in financial markets. They act as a risk management tool and thereby lower the transaction costs of the market.

Provide access to unavailable assets and markets

Derivative enables business in reaching out to hard to trade assets and markets. Organizations with the application of interest rate swaps can obtain better interest rates than available in the current market.

Higher Leverage

Derivatives instruments provide higher leverage than any other instrument available in the financial market. Capital required to take positions in derivative instruments is very low as compared to the stock market. In the case of a future contract, only 20-40% of the contract value is needed whereas, in case of options, only the amount of premium is required for trading.

Types of Derivatives

Future

Future are the standardized type of contracts enter into by parties for buying and selling of underlying securities at an agreed price at some future date. These are traded over an exchange via intermediary and are completely regulated. Future contracts cannot be customized as per the party needs and carry lower counterparty risk. The value of these contracts is decided as per the market movement on a daily basis till the expiration date.

Forward

Forward are simply an agreement between two parties for buying or selling an underlying asset at a specified price at some future date. It is a non-standardized type of contract which is traded over the counter. These contracts are flexible and can be customized according to the needs of buyers and sellers. Forward contracts involve large amounts of counterparty risk as these are unregulated contracts without the involvement of any intermediary.

Options

Options are derivative contracts that provide the buyer a right but not an obligation to buy or sell an underlying asset. The buyer of an option contract pays a premium to the seller for buying such right, whereas the seller is under an obligation to discharge his duty in return for the premium he received. Options are of 2 types: – Call option and Put option. Call option provides the buyer a right but not an obligation to buy an asset at the pre-decided price at some future date. On the other hand, the put option provides the buyer a right but is not under any obligation to sell an asset at some future date at the agreed price.

Swaps

Swaps are the most complicated type of derivative contracts which are entered into for exchanging cash flows in the future between 2 parties. These are the private agreements which are done over the counter. Interest rate swaps and currency swaps are the two most common types of swap contracts. These contracts carry a high amount of risk as the interest rate and currency are underlying assets in these contracts which are highly volatile.

Advantages of Derivatives

Hedging Risk

Derivative contracts are used for hedging risk arising out of fluctuations in price movements. Value of these contracts is dependent upon the value of underlying assets. Investor will purchase those derivative contracts whose value moves opposite to the value of security the investor owns. Therefore, losses in underlying commodities may be offset by profit in contracts of derivatives.

Determine Underlying Asset Price

Derivatives contracts helps in ascertaining the price of underlying assets. An approximation of commodity prices is known through the spot prices of future contracts.

Provide Access to Unavailable Market or Asset

Another important advantage of derivative is that it provides access to unavailable market and assets to peoples. Individuals can acquire funds at lower or favorable rate of interest as compared to direct borrowings with the help of interest rate swaps.

Enhance Market Efficiency

Derivatives plays an efficient role in improving the financial market’s efficiency. These contracts are used for replicating the assets payoff. It enables in getting fair and correct economic value of underlying commodity as these contracts brings price corrections via arbitrage. This way market becomes price efficient and an equilibrium is attained.

Low Transaction Cost

Trading of these instruments involves low transaction cost which is beneficial for investors. This acts as a risk management tool and a protection against price fluctuations. Cost of trading in derivatives is lower as compared to other securities like shares or debentures.

Disadvantages of Derivatives

High Risk

Derivatives contracts are exposed to high degree of risk due to high volatile price of underlying securities. Prices of these underlying securities like shares or metals keeps on changing rapidly as derivatives are mostly traded in open market. This involves a high degree of risk.

Counter Party Risk

There is a possibility of default on the part of counter-party in case of derivatives traded over the counter due to lack of due diligence process. OTC derivatives as compared to exchange derivatives lacks a benchmark for due diligence.

Speculative Features

Derivatives are instrument which are used for speculation purpose for earning profits. Sometimes huge losses may occur due to unreasonable speculation as derivatives are of unpredictable and high risky nature.

Requires Expertise

This is one of the major drawbacks in trading of derivative instruments. Investor’s requires high knowledge and expertise for trading in these instruments as compared to other securities likes stocks and metals.