Contents

Introduction to Employee Compensation

A company recruits various employees for different job positions. These employees perform their respective jobs with hard work and commitment. In return for the services provided by them, they receive some monetary amount fixed by the company. This monetary amount is referred to as compensation.

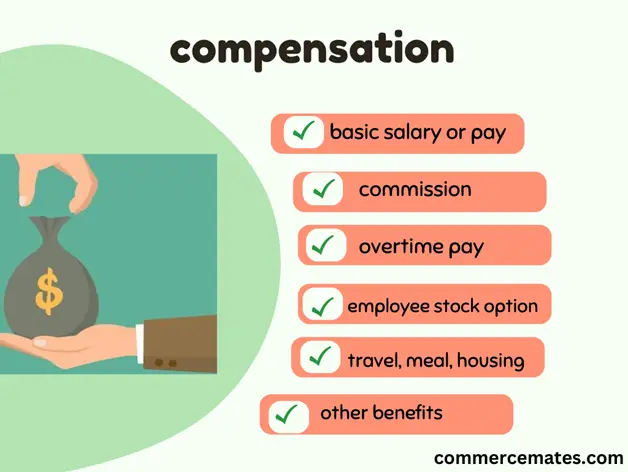

What do you mean by compensation?

Compensation is a method or concept of providing monetary value to employees in the form of salary and other incentives in exchange for their hard work. In simple words, compensation refers to the monetary, non-monetary and other benefits received by an employee in exchange for his services to the company. It includes direct payments to the employee in the form of salary or incentive pay and indirect payments in the form of employee benefits, provident funds, and other services.

The different types of compensation provided by a company to its employees include:

- Basic salary or pay

- Commissions and overtime pay

- Bonuses, profit sharing, merit pay

- Employee stock option

- travel/meal/housing allowances

- Other benefits such as dental, insurance, medical, vacation, leaves, retirement, taxes

What is a Compensation Policy?

A compensation policy is a set of actions or measurements proposed by an organization regarding an employee’s salary, benefits, and bonuses. In other words, a compensation policy is a set of rules that outlines all the aspects of an employee’s compensation, such as employee compensation, overtime pay, bonuses, one-time bonuses, and annual bonuses.

Importance of a Compensation Policy

It is important to have a compensation policy to ensure that the employees are paid fairly and equally according to the work they do. For example, if it is stated in the law that the minimum wage should be Rs. 1000, a compensation policy helps protect the rights of an employee by ensuring that no employee is paid below Rs. 1000.

Moreover, a compensation policy increases the motivation of an employee by promising a fair salary and rewards and recognition for high-performing employees. It motivates employees to work harder and achieve both personal and company objectives.

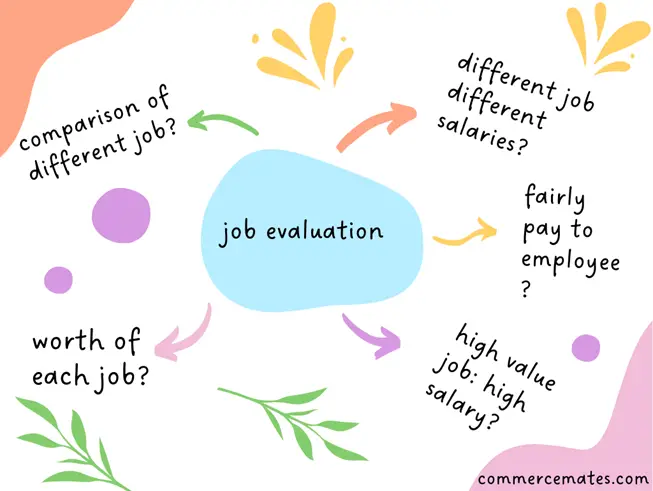

Job Evaluation: An Introduction

Job evaluation is the process of comparing different jobs and finding the value or worth of each job for others. It is a systematic approach to comparing different jobs and their worth.

During job evaluation, the worth of different jobs is determined so that a salary or wage can be paid according to the worth of the job. To pay an employee fairly, it is important to pay them according to their job’s worth. In the absence of this concept, it might be possible that high-value jobs receive low pay and vice versa.

Importance of Job Evaluation

Job evaluation is important to determine the worth of each job. It is crucial to know the worth of each job to determine the salary and ensure that people are paid according to their job positions.

The importance of job evaluation for an organization can be determined by these points:

- It helps in formulating the entire compensation plan.

- It takes into consideration all the factors that are useful in determining compensation.

- Assist in all other functions such as job description, compensation policies, etc.

- Enhance harmony between management and the union.

- Compensate the employee based on their worth and eliminates biases.

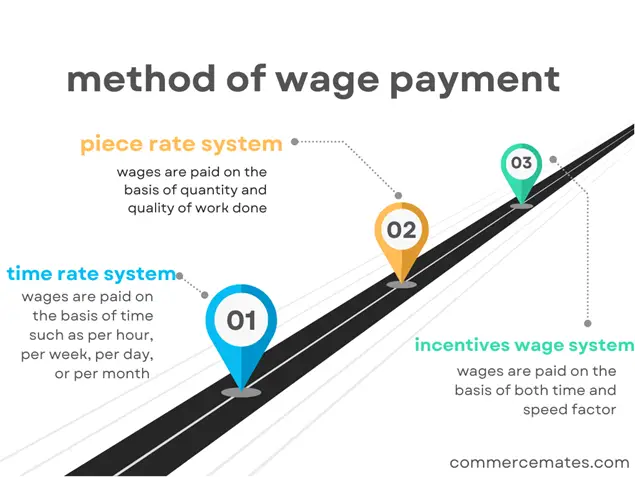

Methods of Wage Payments and Incentive Plans

There are mainly three types of wage payments and incentive plans: the time rate system, the piece rate system, and the incentives wage system. Every system has its unique functioning, merits and demerits.

Time Rate System

Under this method, the wage payment is given to the worker based on time. The time is based on several measurements, such as per hour, per week, per day, per fortnight, or month. This system only considers time as a factor of payment and does not consider production or quantity as a factor. In this system, a worker’s wages are calculated as follows:

Wages = time present by the worker x rate of wage according to time

Merits of time rate system

- Easy to calculate the wage of a worker.

- It provides certainty of the amount payable to a worker.

- It promotes high-quality production.

- Proper utilization of time and factory production.

- Co-operation between labour and capital.

Demerits of time rate system

- Requires supervision at every time-consuming stage.

- This system fails to differentiate between efficient and inefficient workers.

- Lack of motivational tools such as bonuses and promotions.

- High cost of production.

- Increases cost per unit.

Piece Rate System

Under this system, wages are paid to a worker based on the quantity and quality of work they do. The quantity is taken as a basic factor for measuring the work done by a worker. In this system, the wages are calculated as follows:

Wages = Unit of production X rate per work

Merits of piece rate system

- Easy and simple.

- Encourages workers to do more work.

- Proper utilization of machines.

- Increase in quantity of production.

- Best utilization of time.

Demerits of piece rate system

- Lack of unity among workers.

- Misuse of the factor of production.

- Low quality of production.

- Uncertainty of wages.

Incentives Wage System

Under this method, both time and speed factors are taken into consideration for determining the wages of a worker. This method is also known as the “progressive wage system” or “bonus scheme system,” as it provides incentives to the worker for their hard work.

Merits of incentives wage system

- Increase the earning prospect of workers.

- Increase workers’ motivation and spirit to work.

- Enhance workflow and man-machine relationship.

- Reduction in the cost of supervision.

- Increase cooperation among workers.

Demerits of incentives wage system

- Develop a tendency among workers to sacrifice quality for quantity.

- Brings rigidity to operations.

- Employees often ask for incentives without hard work.

- Develop jealousy among workers.

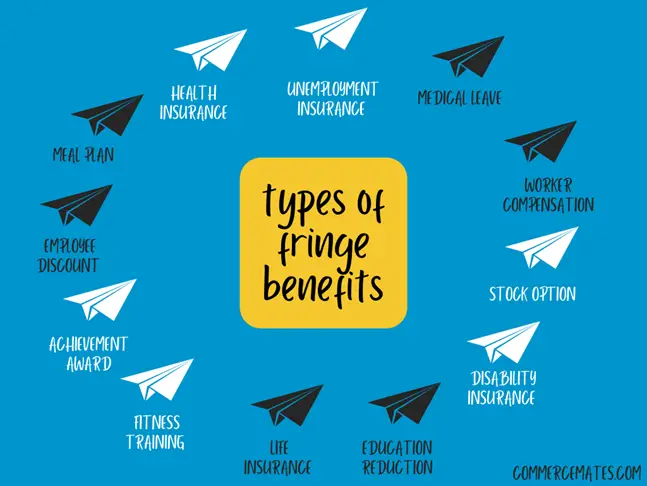

Fringe benefits: Introduction

Fringe benefits are additional benefits provided by an employer to its employees in addition to the agreed-upon salary. These benefits are tax exempted and are given to the employee when a set of conditions are met. Some fringe benefits, such as social security and health insurance, are compulsory as provided by law, but others are voluntary and are given or not by the employer.

Some examples of fringe benefits are free breakfast and lunch; gym membership; employee stock options; transportation benefits; retirement benefits; childcare; education; assistance; etc.

Types of Fringe Benefits

There are various types of fringe benefits available to an employee, such as:

- Health insurance

- Unemployment insurance

- Medical leave

- Workers Compensation

- Stock option

- Disability insurance

- Education reduction

- Life insurance

- Paid time off

- Fitness training

- Achievement award

- Employee discount

- Meal plan

Why Fringe Benefits are Important?

Fringe benefits serve as an additional source of income for an employee. Providing unique and different fringe benefits to the employee helps a company in retaining talented employees and stand out from its competitors. Also, fringe benefits are important to attract a pool of employees with higher education and specialization.

In short, a company can survive in the long run and build its own identity only when it has the right kind of people, with the right specialization, in the right place. Fringe benefits enable a company to attract as well as retain such people.