Contents

What is Financial Literacy?

Financial literacy refers to the understanding and application of various financial skills such as investing, budgeting, and personal financial management. Financial literacy, a lifelong learning process, is the foundation of your relationship with money. You must understand how to manage your money in order to be financially literate. This includes learning how to pay your bills, borrow and save money responsibly, and how and why to invest and to plan for retirement.

Money management is a personal skill that will benefit you throughout your life – and it is not something that everyone learns. With money coming in and out, due dates, finance charges and fees attached to invoices and bills, and the overall responsibility of consistently making the right decisions about major purchases and investments, it’s daunting. Being financially educated allows you to work hard to achieve the American dream, which includes a lengthy and rewarding retirement, without allowing money, or a lack of it, to get in the way of your pleasure.

What makes Financial Literacy so Important?

The Financial Industry Regulatory Authority (FINRA) conducts a brief test of financial literacy every few years as part of its National Financial Capability Study. Inflation, diversification, compounding, bond prices, and consumer awareness of these concepts are all measured by this test. The study found an association between exam performance and significant indicators of financial competence in general. A little over a third of responses on the most recent test had four or more right answers out of five, which is a sign of widespread financial ignorance.

People are finding it more difficult to manage their finances as a result of changes in consumer behavior and financial products. In the past, the majority of people used cash for daily purchases. Credit cards are being used more frequently these days. Credit was used for 27% of payments in 2019, up from 24% in 2017.

We also shop differently now. Many people now prefer to shop online, which makes it easy to use and overextend credit, an all-too-common way to quickly accumulate debt.

Meanwhile, credit card companies, banks, and other financial institutions are inundating customers with credit opportunities—the ability to apply for credit cards or pay one card off with another. If you lack the necessary knowledge, it is easy to fall into financial difficulties.

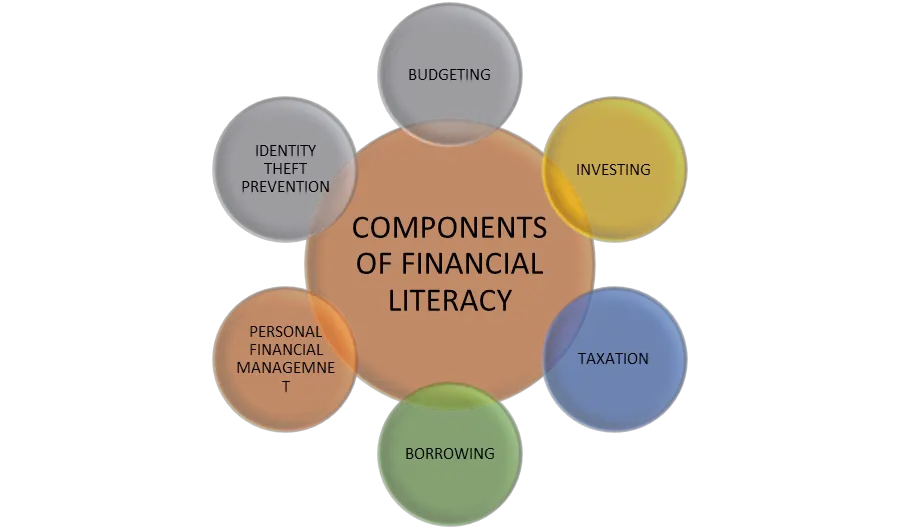

Fundamental Components of Financial Literacy

Financial literacy is comprised of several financial components and skills that enable an individual to gain knowledge about effective money and debt management. The fundamental components of financial literacy that should be learned are listed below –

Budgeting

The size of the budget is determined by the four basic uses of money in budgeting: spending, investing, saving, and giving. By striking the proper balance between the basic uses of money, people can better utilize their income and achieve financial stability and prosperity. In general, a budget should be created to pay off all current debt while setting aside money for savings and wise investments.

Investing

Those seeking financial education should educate themselves on important aspects of investing. Interest rates, price ranges, diversification, risk-reduction strategies, and indexes are just a few of the things that investors should learn about in order to make profitable investments. By learning about key investment components, people can make better financial decisions and even increase their income.

Taxation

Learning about the various taxation systems and how they impact a person’s net income is necessary to develop financial literacy. Whether the money comes from a job, an investment, a rental property, an inheritance, or something unanticipated, every type of income is taxed differently. Financial performance and economic stability are facilitated by understanding the various income tax rates.

Borrowing

In the majority of circumstances, almost everyone must borrow money at some point in their lives. To ensure that borrowing is done effectively, it is crucial to comprehend interest rates, compound interest, the time value of money, payment terms, and loan arrangements. A person’s financial literacy will increase if the aforementioned criteria are completely understood, leading to more useful borrowing advice and a decrease in long-term financial stress.

Personal financial management

The majority of the aforementioned components are combined in personal financial management, which is the most important component. In order to enhance and increase investments and savings while decreasing borrowing and debt, the aforementioned financial mix must be adjusted. As someone gains a solid understanding of the financial concepts discussed above, their degree of financial literacy will increase.

Being cautious about identity theft

Identity theft can have a significant negative impact on both daily life and grades. This might occur if someone obtains your social security number, credit card number, or login information for any of your online accounts. Some forms of identity theft are straightforward to stop. However, if someone uses this information to open credit accounts in your name or steals your identity, it may take months or even years to recover.

Scope of Financial Literacy

Financial literacy can refer to a variety of abilities, but some common examples include developing a household budget, understanding debt management and repayment, and weighing the benefits and drawbacks of various credit and investment options. These skills frequently necessitate at least a basic understanding of important financial concepts such as compound interest and the time value of money.

Other goods, such as mortgages, student loans, health insurance, and self-directed investment accounts, have also grown in importance. People must now be much more aware of how to use them responsibly than in the past.

Financial literacy includes not only long-term financial strategy but also short-term financial strategy. Financial literacy includes understanding how your current investment decisions may affect your future tax payments.

Benefits of Financial Literacy

Overall, the benefit of financial literacy is that it empowers people to make better decisions. Financial literacy is important for a variety of reasons, including:

Financial literacy can help you avoid costly mistakes

When compared to standard IRA contributions, floating-rate loans may have variable monthly interest rates that cannot be withdrawn until retirement. Even seemingly unimportant financial decisions can have long-term effects that cost people money or interfere with their plans for the future. Financially literate people are less prone to make mistakes when managing their personal finances.

Financially literate people are better equipped to handle emergencies

People are prepared for the unexpected by learning about financial literacy topics like saving and disaster planning. Even while losing a job or facing a sizable unforeseen bill is always devastating financially, a person can lessen the damage by developing financial literacy beforehand and being ready for emergencies.

Individuals can achieve their goals with the help of financial literacy

By learning how to budget and save money better, people may make plans that set expectations, hold them responsible for their finances, and design a road for accomplishing seemingly impossible goals. Even if someone can’t afford a desire right now, they may always come up with a plan to increase their chances of having it come true.

Financial education fosters trust

Without having all the information necessary to make the best option, think about making a decision that will affect your life. People who have the right financial knowledge can approach important life decisions with more assurance because they know they won’t be as surprised by or negatively affected by unexpected events.

Thus, we can say that financial education is a skill that provides a variety of benefits that can raise people’s living standards by increasing their financial security. Taking steps to become financially literate is an important part of life because it can help to ensure financial stability, reduce anxiety, and promote financial goal achievement.