Contents

What is Savings and Investment?

Savings and investment are the main two important aspects of the financial and economic environment. A balance of both savings and investment is to be maintained by one to achieve fair financial control over the financial mechanism.

Let us take into consideration a simple example. Raju an employee in a private firm earned a bonus of Rs.10000 apart from his regular salary. He is confused about what to do with the money. He has mainly 4 options in front of him. they are

- Save the entire amount of money

- Invest the money in different schemes

- Spend the entire money

- Invest a small amount of money and save the rest.

When he goes through these options, he will find the best alternative according to his current financial position. The alternative chosen by Raju might not be the optimum solution for any other person. We can understand that savings and investments are different from person to person and change according to the different market conditions. Let us look deep into what I meant by savings and investment.

An overview of savings and investment

Savings and investment are 2 financial aspects which are offered to any individual according to the financial security they desire. Savings are expenditures set aside from the income of an individual. Whereas investment is the investing or buying of different financial assets with the hope of generating an income in the future. An individual should be able to distinguish between savings and investment and should be able to utilise the money with him according to his financial requirements. Savings are usually safer than investments. Whereas the return on investment is more than what is earned from savings. Now we will discuss in detail each aspect.

Savings: Meaning and Types

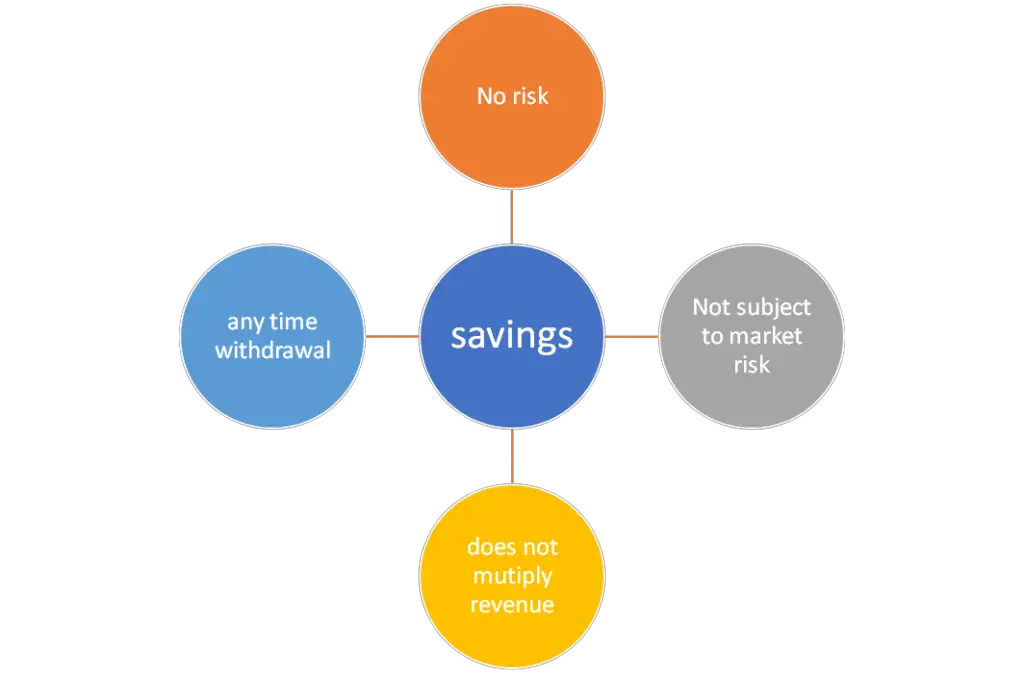

Savings is the money kept aside after the expenses of an individual. It is the leftovers of the money after covering all his expenses of him. this is usually set aside by individuals in case of meeting an emergency which arises due to undesirable occurrence of events. Savings are mainly chosen by individuals who are not interested to take the risk and will require money every short interval.

Savings come under different avenues according to the different needs of the individual. The most common practice of investment includes

- Savings accounts:

- These are usually maintained in a bank account and can be withdrawn at any time.

- These accounts help the individual to overcome emergency crises ad helps them from falling into debt.

- They offer low-interest rates.

- Fixed deposits:

- They offer a higher rate of interest

- Usually, the money is deposited for a fixed period and breaking this can attract penalties.

- It is also called term deposits.

From the above, we can understand that we deposit or save our money wisely and we are guaranteed that we will get that money when it matures or when we need it. But what if I want my money to multiply? I don’t want to keep my money aside. Rather I want to take the risk and increase my return. This is when investment enters the scene. Let us now see what is investment.

Investment: Meaning and Types

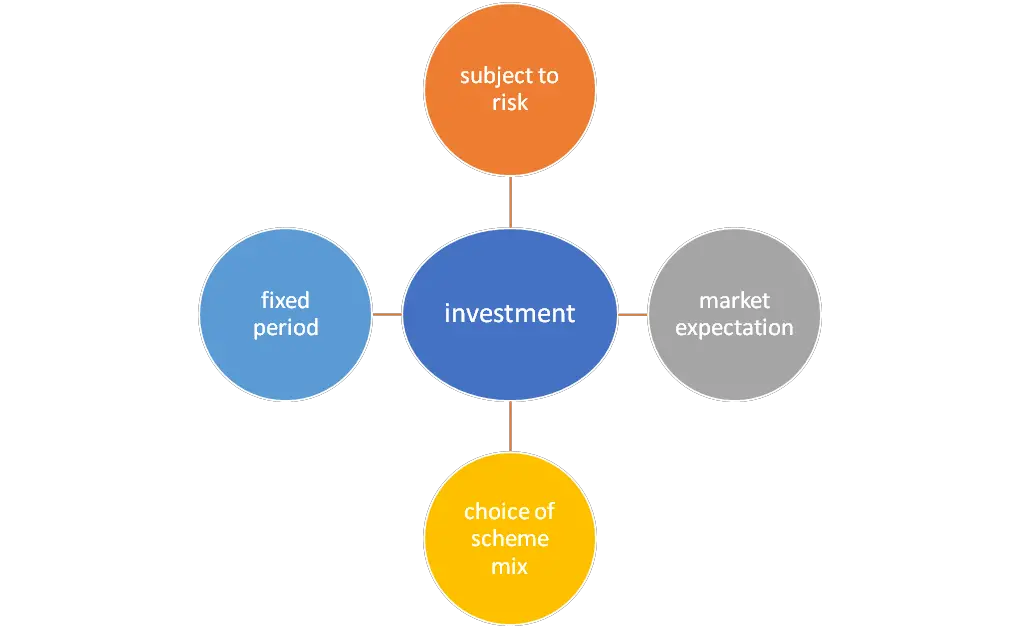

Investment simply means setting aside a certain amount of the income generated by an individual and depositing them or using them to buy certain financial securities or assets to generate a higher income in future. It is the sacrifice of the current consumption pattern of the individual’s income earned. Investment always yields a higher return and there are also chances due to market fluctuations occurring in the market. It is usually from the macro point of view and the control is beyond the individual’s power.

There are different types of investment avenues that are provided to an income-generating individual. They are like:

- Money market instruments:

- The maturity period is less than 1 year.

- High liquidity and minimum risk

- Different instruments like treasury bills and commercial papers are the most common ones.

- Bonds and debentures:

- Long-term debt instruments.

- Have higher safety of repayment in case the company goes into liquidity.

- Bonds are usually issued by the government. Debentures are issued by different listed companies on the stock exchange.

- Equity shares and preference shares.

- These shares have a higher rate of risk as compared to debentures.

- These are convertible.

- Equity shares as subject to loss if the company goes into liquidation or loss but will yield higher profits if the company is much more successful

- Mutual funds:

- Subject to its highest market risk.

- These are in different forms of both debt and equity,

- There will be a combination of all these schemes.

The other investment avenues are government schemes, retirement schemes, real estate, insurance products etc.

Now we have a clear-cut idea of what is an investment and what is savings. Let us now have a comparison of both investment and savings.

Difference between Savings and Investment

| Basis of difference | Investment | Savings |

| Liquidity | Usually invested for some time. Less liquidity until it reaches the maturity date. | Highly liquid and can be withdrawn at any moment in time. |

| Knowledge | The investor or the individual should know about the current economy of the country before investing. | No knowledge is required as the money is kept aside by himself rather safely with him. |

| Return | There are high chances of increased return when invested in the correct avenue. | There is no provision for return as it is negligible or no profit earned on savings schemes. |

| Risk | High rate of risk according to the market condition. | No risk or minimum risk. |

| Basis of decision | Long-term investors decide to invest for yielding profit in future. | The person who needs money every other day save their money and does not think of yielding profit in the future |

| Types of funds | Investors use both owned and borrowed funds. | The individual saves his funds and does not put himself into a position of debt |

| Tax shelter | Investments usually provide a tax shelter and help individuals to manage funds efficiently. | Savings does not provide any tax shelter. The whole amount saved by the induvial is subject to tax computation |

From the above table, it is clear that even though we use savings and investment interchangeably both have their supremacy in the respective fields. So how can we choose which is better?

Advantages of Investment over Savings

- Tax shelter:

The most common and foremost advantage of investment is the tax benefits which they possess. Certain investment schemes even have tax exemptions which will help the investors to manage their funds efficiently and they will also be eligible for a future profit or increase in their revenue.

- Future earnings:

People who look forward to earning a specific amount in future will try investing their money in different avenues. They will have to deposit these amounts for a specific period according to the nature of the instrument in which they are investing. And don’t forget all this is subject matter to market risk!

- Risk-taking capacity:

An individual who is ready to take risks will invest. There are chances of loss and there are also equal chances of gain. So, looking on the brighter side the person who is “adventurous” will invest in more risky schemes like equity funds and a person who is willing to take a small amount of risk will invest in government securities or bonds which is much safer.

- Wide range of avenues:

In the previous point, we discussed that there is an availability of schemes for different types of individuals according to their risk-taking capacity. From that point, we can understand that there is a wide range of avenues available according to the need of each individual.

Disadvantages of Investment over Savings

Every coin has two sides. Likewise, there are certain cons to investment. And definitely, these are also the advantages of savings over investment.

- Liquidity:

Investments do not have a high liquidity rate as compared to savings. Savings can be used at any point in time whereas investments can be withdrawn only after their maturity.

- Chances of going into debt:

If the investment is done in the wrong avenues the individual has a chance of going into debt. Savings always help to overcome emergencies even in case of bankruptcy.

- High knowledge regarding the market is required:

If the asset combination that the investor chooses is wrong there is a high chance of loss of return for the investors. There are even cases where the investor cannot recover the principal amount which he invested in the scheme.

Conclusion

Investment and savings are 2 ways in which an individual can utilise the income earned by him. a person who is interested in taking the risk and expect a higher rate of return rather than the amount which is already earned by him he will invest in the different avenues which are available for him. on the other hand, a person who always prefer to play safe and keeps aside an amount of money for the unexpected events which might occur will save a small portion of the money after all his expenses. So after this, we can conclude that savings and investment must be hand in hand for the smooth functioning of a person’s financial happenings.