Contents

Meaning of Cost Accounting

Cost Accounting is a branch of accounting concerned with recording and analyzing the cost elements of the organization. It records each element of the company’s total cost of production including fixed cost and several variable costs involved in various stages of production. All cost elements are recorded, summarized, and presented in a better way for proper understanding by the internal users of the organization.

Cost accounting is considered as the subpart of managerial accounting and helps the managers in better management of the organisation. It supplies all detailed information concerned with production cost to managers so that important decision regarding controlling costs can be taken. The information collected by cost accounting is not available for external users but is only used by internal users for management purposes.

Cost Accounting has an important role in improving the cost-efficiency of the organisation by taking strategic decisions. Cost accounting is of different types: Standard cost accounting, Marginal accounting, activity-based accounting, and lean accounting. It performs a wide range of functions that are essential for the successful functioning of the business. The scope and functions of cost accounting are discussed below:

Functions of Cost Accounting

Ascertainment of cost

Cost ascertainment is an important function played by cost accounting. It records each and every element relating to production activity systematically like fixed and variable cost, direct and indirect cost. The data collected by cost accounting is analysed by managers in determining the true and actual cost of products. Nowadays businesses manufacture a wide and large range of products, in the absence of cost accounting, it becomes difficult for them to find out the real cost of their products.

Controlling cost

Cost accounting helps the organization in controlling its cost. Organization sets standards for their cost which are treated best for the achievement of goals and objectives. Cost accounting supplies detailed information related to the cost of each step of production. This information collected is then compared with standards already set and if any deviation is found, necessary steps are taken. Therefore it helps in the detection of deviations in cost and time controlling them.

Aid to management

Cost accounting supports the managers in performing their duties. It supplies them all necessary and relevant data to the managers periodically that may be monthly, quarterly or half-yearly. Managers analyze the detailed cost information supplied by cost accounting and accordingly take decisions. They framed and implement policies in the organization as per the information collected. It helps them in taking strategic decisions and better management of organization affairs.

Setting up selling prices

Fixing up the right selling price for its product is a challenging task for every business organization. Cost accounting helps in the ascertainment of the accurate cost of production of products. By adding the profit margin to the real cost company can easily fix the selling cost for its products. Businesses under cost accounting use different techniques like batch costing, job costing, service, and output costing for determining the selling price of its products.

Inventory control

Cost accounting helps in controlling the inventory by recording each item of inventory. It maintains complete records of all raw materials so that timely proper order for raw materials can be made. It avoids all situations like over-ordering and under-ordering of raw materials. Also, the complete record of finished goods is made so that accordingly production process can be regulated. It avoids wastages of resources and the occurrence of losses for the organization.

Measurement of efficiency

Cost accounting helps in measuring the efficiency of business operations. Managers can easily acquire information regarding production cost which can be analyzed to find out how efficiently a business is running. It helps in avoiding wastage of different resources of the organization through proper monitoring. It uses a standard cost method in measuring the efficiency of each process, product and department.

Discloses profitable and non-profitable activities

Cost accounting gives clear details of each activity of business to managers that which one is profitable and which one not. It supplies all detailed information regarding the cost of each product of the business. Managers by comparing the cost of the product with demand in the market can decide whether to continue its production or not. It, therefore, helps in determining profitable and non-profitable activities of business by managers.

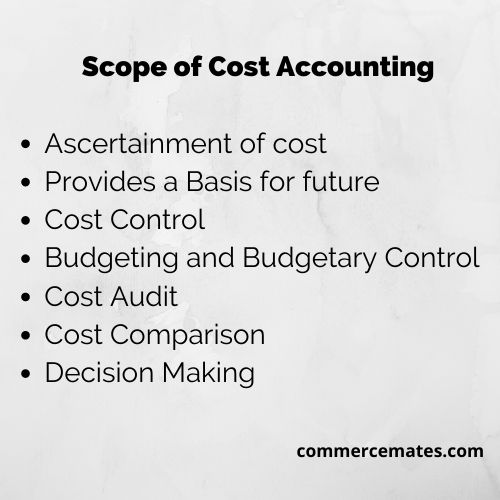

Scope of Cost Accounting

Ascertainment of cost

Cost Accounting deals with the Ascertainment of cost. it gives a true and fair view of the actual cost involved in the different processes in the organization. Managers have detail information regarding cost and easily regulate the control as per the budget this helps in true ascertainment of the cost.

Provides a Basis for future

Cost Accounting collects detail information regarding the cost of different departments of the organization. The manager uses this collected information for predict the actual cost of future operations. This true ascertainment for batter plans to achieve the goals.

Cost Control

The cost account helps in the estimation of the actual cost. Managers can use this information in controlling the cost and ensure that all activities go to a predetermined budget manager can take necessary action to control whenever anything goes out of the budget.

Budgeting and Budgetary Control

Cost accounting has an important role in deciding the budget it collects information regarding cost form different sources within the organization. This information is analyzed by the manager to design the optimum budget. It is insured by the manager that all expenses go within the decided budget and if necessary action being taken to control the cost

Cost Audit

Cost Accounting has an important role in performing the audit of different costs. An auditor can easily acquire all relevant information through the data aquire by cost accounting. It makes comparison and verification of various data easy an error can be deducted

Cost Comparison

Cost accounting provides the data of actual expenditure and income. So we compare the actual cost with the standard cost. To find out the cause of difference and the corrective measures will be taken.

Decision Making

cost accounting provides all information to the manager for effective decision making. The manager analyzes the data acquired by cost accounting and formulate the plan and policies. It helps the manager in better understanding by depicting the true and fair picture of the organization. Manager can take a best suited decision as per the organization need to drive the maximum result

Objectives of Cost Accounting

Process Of Accounting For Cost

Cost accounting is a process of recording the income and expenditure of the organization. Objective of cost accounting is to find out the cost. cost includes raw material cost, labour cost, fixed cost and other cost which is related to the production.

Records Income And Expenditure

Cost Accounting records income and expenditure which is related to production. cost accountant constantly track and analyze the per-unit cost of the product. so that the true and fair cost of production will find out.

Provides Statistical Data

Cost Accounting provides statistical data for analysis and interpretation of cost in production. It helps in proper and efficient planning and also helps in the preparation of the budget.

Helps In Cost Control

Cost Accounting helps in cost control. Cost control a process of identifying and reducing business expenses. so the profit of the organization increase. cost accounting comparison of Actual cost with Standard cost and find out the problems. Then corrective measures are taken into steps.

Preparation Of Budget

Budget is the estimation of income and expenditure over a period of time. Cost accounting provides statistical data for the preparation of the budget and proper and efficient planning.

Comparison Of Actual With Standard

We make standard cost in budget and planning. But cost accounting provides the data and the correct information of the actual cost. So that we can Compare of Actual cost with the Standard cost.

Presentation Of Correct Information

Cost accountant regularly track and analyze the cost of the product. Cost Accounting provides the raw data. Data processing convert the raw data into information. Hence Cost Accounting is present of Correct.

Helps In Decision Making

Cost Accounting helps managers to decide. It provides the information to management related to production. That helps to take decision and planning for future.