Contents

What is Accounting Standards

Accounting Standards simply refers to guidelines to be followed in the accounting system. It means rules & regulation that are to be followed while recording accounting & financial transactions. It governs the manner in which financial statements are prepared & presented.

The main aims of accounting standards are to bring uniformity & reliability in the whole accounting system. Accounting standards standardize the whole accounting procedure of the economy. All companies after adopting these accounting standards follow the same manner of recording transactions.

This way the whole accounting system becomes easy & easily understood by all. It prevents happening of any fraud by establishing certain norms & principles. Accounting standards are issued by the accounting body of the respective country. In India, Institute of Chartered Accountants of India formulate & issue Accounting standards. These standards are followed by accountants & companies in preparing & presenting financial statements.

Nature of Accounting Standards

Guider for accounting

Accounting Standards serve as a guide for the whole accounting system. These standards guidelines & standards for different accounting treatment. Accounting standards govern the manner in which financial statements are prepared & presented.

It provides guidelines on every matter to accountants for preparing accounts. Therefore, it eases the accountants work by simplifying their work by guiding them.

Mandatory to follow

Accounting standards are not optional to be followed by companies. They are mandatory in nature. Accounting standard’s need to be implemented in their accounting process by every company.

Through a provision in company law, these standards are made mandatory for companies. Whereas the members of the Institute of Charted Accountants of India imply these standards on other entities.

Framed according to law

Accounting Standards are prepared in accordance with the prevailing laws of the country. Laws of country cannot be overridden by Accounting standards. Business environment is also considered while preparing Accounting standards.

As laws & business environment keeps on changing. Therefore, Accounting standards are also revised from time to time according to need. Also, laws of country prevail in case of conflict between accounting standards & laws.

Serves as a harmonizer

Accounting standards work to bring uniformity to the whole accounting system. It sets the same guidelines & standards for every business for accounting treatments. Companies are required to prepare & present financial statements as per the same accounting standards.

This way uniformity is brought in the whole accounting system. Accounting standards are not biased. They aim to remove the concept of different accounting policies being followed. Whenever there is an issue regarding some accounting treatment, it provides clear guidelines.

Flexible in nature

Accounting standards provide flexibility to the business. These do not compel companies to follow their instructions in every matter. In many cases, companies are free to adopt any method when the option of different accounting practices is available. Companies can choose any of the alternatives with proper & full disclosure.

Like there are different methods of stock valuation. These are the weighted average method, LIFO & FIFO method. Company is free to choose any of them by giving disclosure in financial statements. This nature of accounting standards provide flexibility to businesses.

Avoids frauds & data manipulation

Accounting Standard provides guidelines for each & every accounting treatment. It aims at reducing the errors & chances of manipulation of data by management. Companies are strictly bound to follow the guidelines of Accounting standards.

It also adds reliability to financial statements. Investors & different stakeholders depends on financial statements for acquiring information. So, getting the right information becomes quite important for them.

Issued by Authority

Accounting Standards are issued by the concerned authority that is accounting body of the respective country. These are not framed according to companies. But same accounting standards are framed by accounting body of country.

All companies need to follow the same accounting standards. In India, Institute of Charted Accountants of India formulate & issue Accounting standards.

Helps in easy comparability

Accounting standards helps in easy comparability of financial statements of different companies. These standards generally bring uniformity in the whole accounting process.

All companies follow the same guidelines for the same accounting treatments. This makes the comparison between financial statements possible & easy.

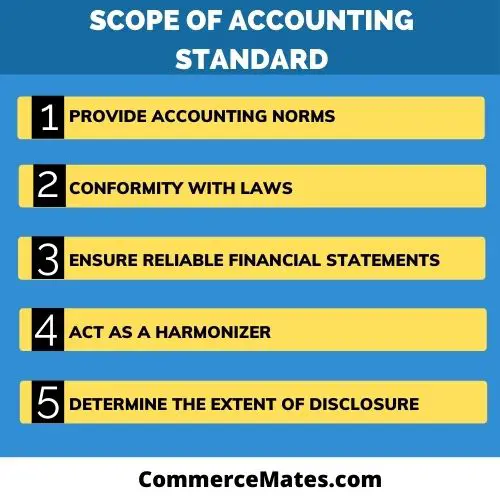

Scope of Accounting Standard

Provide accounting norms

Accounting standards provide norms which serve as the basis for preparation of financial statements of company. It gives a complete guide for accounting processes to accountants. All transactions are recorded and presented in account of business as per the guidelines provided by accounting standards.

Conformity with laws

These standards are formulated and issued in conformity with provisions of all applicable laws, customs and business environment of a country. In case, if any accounting standard is not found in conformity with any of the law, then provision of such law will prevail over the accounting standard.

Ensure Reliable financial statements

Accounting standards ensure that financial statements prepared by company deliver reliable information. These standards act as a dictator which guide the accountant by providing the rules and format to be adopted in preparing financial statements. When accounts are prepared following these standards, reliability of information provided to user get increased.

Act as a Harmonizer

Accounting standards acts as harmonizer for solving any conflict arising in accounting process of organization. These standards are non-biased in nature and aims at attaining uniformity in whole accounting procedure. Diverse accounting policies and practices are avoided and standardized concepts are provided by these standards. Therefore, when all accounting process are uniformly followed then an accountant can easily provide solution to any conflict arising on accounting issues.

Determine the extent of disclosure

These standards determine the extent to which financial information should be disclosed by company in its financial statements. It ensures that detailed information is provided in true and fair manner to all users of accounting information. Availability of true accounting information in a correct manner leads to strategic decisions.