Contents

What is Accounting Standards?

Accounting Standards simply refers to guidelines to be followed in the accounting system. It means rules & regulation that are to be followed while recording accounting & financial transactions.

It governs the manner in which financial statements are prepared & presented. The main aims of accounting standards are to bring uniformity & reliability in the whole accounting system. Accounting standards standardize the whole accounting procedure of economy.

All companies after adopting these accounting standards follow the same manner of recording transactions. This way the whole accounting system becomes easy & easily understood by all.

It prevents happening of any fraud by establishing certain norms & principles. Accounting standards are issued by accounting body of the respective country.

In India, Institute of Chartered Accountants of India formulate & issue Accounting standards. These standards are followed by accountants & companies in preparing & presenting financial statements.

Benefits of Accounting Standards

Bring uniformity in accounting

Accounting standard plays an efficient role in bringing uniformity in whole accounting system. It provides a standardized rules and regulations regarding treatment of financial transactions and events. Financial statements of company are also prepared and presented as per the standard format specified by these accounting standards. This way it leads to uniformity in whole accounting methods.

Avoids frauds and manipulations

These standards pay attention on avoiding any frauds or errors within the organization. Accounting standards provide complete framework and guidelines that need to be followed compulsorily by every entity. All accounting information is recorded and presented in accordance with the provided principles. These standard makes it quite difficult for managers to manipulate the facts or commit any kind of fraud.

Enhance Reliability of financial statements

Accounting standards impart reliability to financial statements prepared by an organization. Following of these standards ensure that all financial information of company is presented in a fair and true manner. There are many stakeholders who are user of financial statements and take it the base for taking various crucial decisions. These standards make sure that all information presented is trustworthy that leads to correct decisions.

Assist auditors

These standards help auditors in verifying the correctness of company accounts. Accounting standards provides all accounting rules and regulations to be followed in a written format that enables auditors to follow uniform practices. Auditor can easily assure the fairness of account by checking out whether all policies provided by accounting standards are followed or not.

Facilitate comparability

One of the important benefit provided by accounting standards is that they facilitate the comparison of financial statements of companies. When uniform accounting policies, rules and regulation are compulsorily followed by each entity, then comparison of their performance become quite easy. Financial statements can be easily evaluated by users and also performance comparison among distinct companies can be made before taking any decisions.

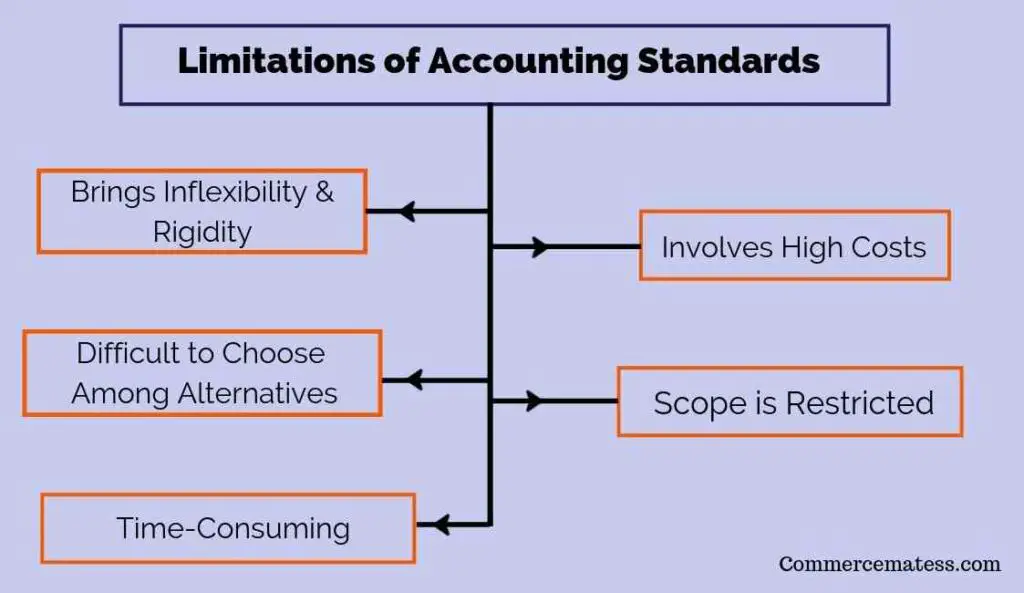

Limitations of Accounting Standards

Accounting standards have important role in the accounting system. Apart from their importance, they have certain limitations also. Some of these limitations are discussed below:

Brings Inflexibility & Rigidity

It is one of the major disadvantage of accounting standards. Accounting standards basically establish each & every principles and rules for accounting treatment. Every company is required to follow the same principles constantly.

Therefore all companies are required to fit themselves into guidelines of accounting standards. Every companies goes through different situations & have different financial transactions. Sometimes it becomes difficult for them to follow the same guidelines.

Involves High Costs

Another disadvantage of following accounting standards is that it involves high costs. Implementing accounting standards in your accounting standards is too costly.

Company need to change their entire procedures, upgrade their systems & provide their employee’s training accordingly. Companies need to monitor whether employees are correctly following standards. All these activities require large costs for bringing changes.

Difficult to Choose Among Alternatives

Choosing among different alternatives available is another disadvantage of Accounting standards. Accounting standards provides many options for treatment of the same accounting concept.

It becomes difficult for companies to decide which one is best for them. Accounting standard does not clearly state that which one is the appropriate choice. For ex. for stock valuation there are 3 alternatives available. These are weighted average, FIFO & LIFO method. Choosing which one is best is difficult task.

Scope is Restricted

The accounting standards are followed in accordance with prevailing laws & statutes. Accounting standards cannot override the statutes & laws. These standards are created & framed in accordance with prevailing laws. Using these standards as per the prevailing laws can limit & restricts their scope.

Time-Consuming

Another drawback of Accounting standards is that it is time-consuming. Implementation of accounting standards requires many steps to be followed to prepare financial report. It makes the process of preparing financial statements complex & time-consuming.

It defines each & every step for preparation of financial reports. Accounting standards involves income statement, trial balance & balance sheet preparation. Accountants need to strictly comply with rules of accounting standards. It makes their work complex & rigid.

Read More:

Scope & Nature of Accounting Standards

Importance of Customer Relationship Management

Functions of Insurance Firm