Contents

Meaning of Dematerialization

Dematerialization is a process of conversion of physical certificates of shares held by investors into electronic format. Under this process companies destroy & cancel the physical certificates of shares.

After this companies credit the respective number of shares of investors in electronic form in their account. The investor account is one which is open by investor with the depository participants (D.P.). (Depository participants are known as agents of depository & they act as a middleman between depository & investors.)

The overall dematerialization process is conducted by companies at the request of their respective investors. Dematerialization offers a wide range of benefits to investors. It provides a great convenience, security & flexibility to investors.

Investors get free from different hassles in the trading process like physical share certificates loss, delay in certificate transfer process, Stamp duty payment on securities transfer, TDS deduction for Demat securities and many more.

Account opened under dematerialization process with depository agent is credited with purchases of investors & debited with sales of investors. However, the dematerialization process follows a series of steps before share physical certificates are converted into electronic format. These steps are discussed below.

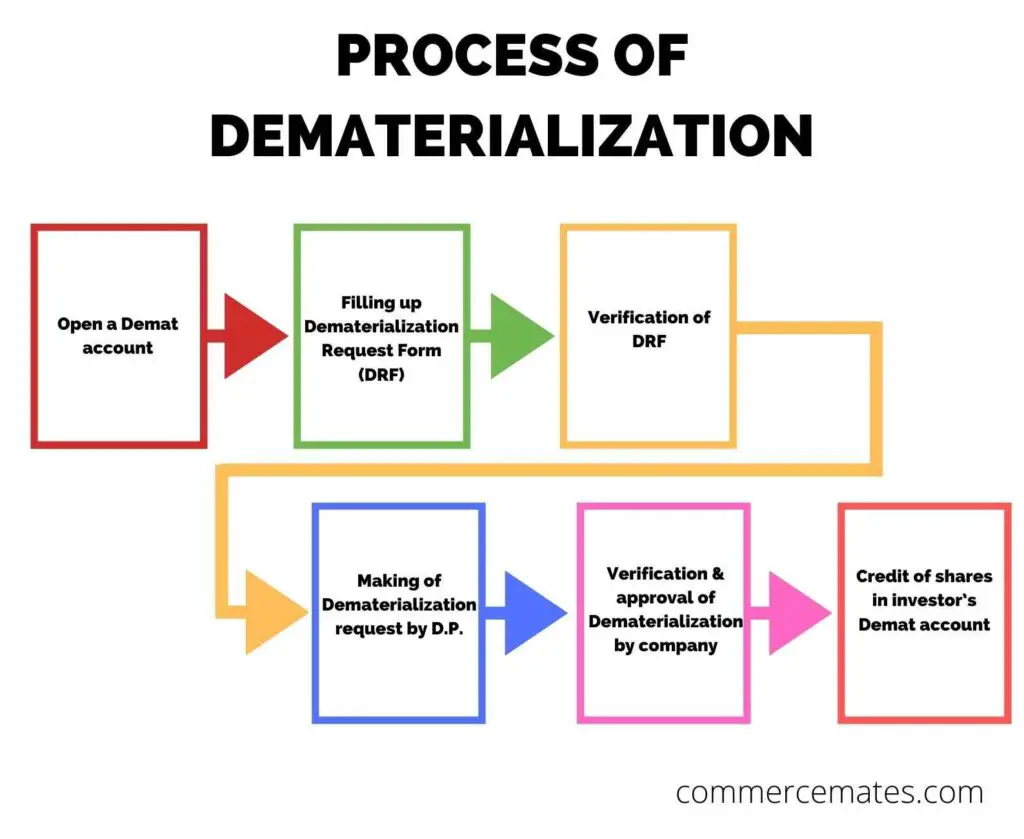

Process of Dematerialization

Open a Demat Account

The first step in the dematerialization process is the opening of Demat account. The investor/ beneficiary account is required to shortlist among different depository participants to open a Demat account.

Demat account is generally an account that is used for holding share online in electronic format. The depository participant may be a bank or a stockbroker that is served as the intermediary between depository & investor.

Filling up Dematerialization Request Form (DRF)

After opening of Demat account, now investor is required to fill up a request form for dematerialization of its securities. The form is available with Depository Participants. Along with this form, share certificates need to be surrendered by the investor. There should be a clear note on each share certificate – “Surrendered for Dematerialization”.

Verification of Dematerialization Request Form (DRF)

This involves verification of details entered by investor in Dematerialization Request Form. Here Depository Participant assures that DRF is correctly filled up by the investor. The depository participant performs a security process involving verification of name mentioned on DRF & name on certificates with client account, paid-up status, checking of client signature on DRF with specimen signature, etc. If everything is found correct by depository agent in DRF, he issues a duly signed & stamped acknowledgement slip to investor.

Dematerialization Request By Depository Participants

After successful verification of DRF form and another document, the depository agent initiates the dematerialization process. Depository participant will process request for dematerialization on the depository system that is NSDL or CDSL. He will also initiate the request along with share certificates for demat to the company, registrar and transfer agents through depository.

Verification & Approval of Dematerialization by Company

Here the company initiates the process for dematerialization of shares of its investors. On receiving of demat request by depository participant through the depository, firstly genuineness of certificates and other documents is verified by the registrar and transfer agents.

If all thing are found in order, physical share certificates are destroyed by company for demat process. After destroying of certificates, the company send the dematerialization confirmation to the depository.

Transfer of Shares in Investor’s Demat Account

On receiving the confirmation from the company, the depository will credit the demat account of investor with equivalent shares. The depository will send the confirmation to depository agent who will finally update the investor account & inform him of demat process.