Contents

Meaning of Retirement Planning

Retirement planning refers to preparing for your future before it actually happens so that it will help you to fulfill all your dreams and live the life in the future that you wish to. Planning for your future can be done by saving the money that you estimate you will need in your future and setting your retirement goals.

Each person has a different retirement plan, depending on how he wishes to spend his retired life. Thus, one needs to work accordingly by making a retirement plan in the present to have a secure retirement life.

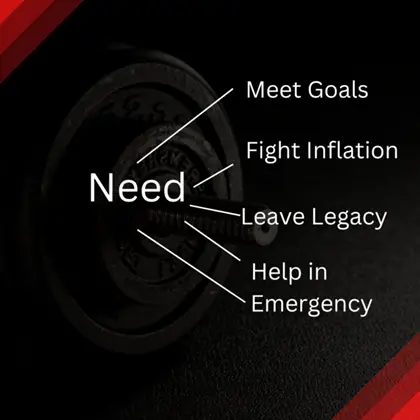

Need of Retirement Planning

In order to have a secure life after retirement, one needs to have efficient retirement planning. One can have several dreams for his retirement life and should work accordingly in the present and save enough so that he doesn’t need to worry about it in his life after retirement and also not depend on anyone.

To meet your goals – Retirement is a new phase of life with different dreams in which you have enough time to visit all the places that you wish to and start living life only for yourself. All this can be done by having an appropriate retirement plan.

To fight inflation – In a country like India, prices grow unexpectedly and at a great scale, which can make a person’s easy survival difficult. Thus, one must have a proper retirement plan to fight against inflation.

To leave a legacy – By making an efficient retirement plan, you can also plan to leave some wealth for your family so that they do not face any financial problems even in your absence and can live their lives peacefully.

To help in an emergency – One needs to keep himself ready for such situations where you are not dependent on anyone. Thus, with a correct retirement plan, one can get prepared for situations such as financial expenses and medical emergencies.

To improve your lifestyle – If one wishes to live a similar lifestyle in the future that he is living in the present or even to improve his lifestyle, then he needs to have a proper retirement plan. It will make sure that you have enough resources to fulfill your daily expenses.

Importance of Retirement Planning

Aid in medical emergencies – In life after retirement, one needs more medical facilities, and the retirement plan helps to have enough savings for the same that would help you in medical emergencies.

Financially independent – The income saved by the person can help him to fulfill and meet his financial requirements if the person had made a proper retirement plan in his early days. The plan can help a person to live the same lifestyle after his retirement the way he is living currently.

Assist your family – A retirement plan not only helps you in your life after retirement but also helps your family. The savings you made earlier can help your family to meet their financial needs, especially in the time of emergency and even in your absence. They will not have to depend on anyone in such situations.

Meet your financial goals – People have several financial goals for their life after retirement aside from the basic requirements that they need. A retirement plan helps to fulfill your goals, which may include travelling or starting a small and easy side business. Having a retirement plan will help you to be financially independent even in the time of any emergency.

Help in early retirement – If a person wishes to have his retirement at an early age or is forced to do so, then it would be easier for them to live their life if they had planned their retirement in their initial days of work. It would be difficult for people to survive or live peacefully if they have no retirement plans and are forced to take an early retirement.

Benefits of Retirement Planning

Returns – Retirement plans that include saving a small amount of money every month throughout your life would help to give you returns for your life after retirement. It would help you to stay financially independent in your life even if you have an emergency.

Regular income – A proper retirement plan helps you to receive a regular income throughout your retirement life. This regular income can be used to meet your daily expenses in your life after retirement, which include medicines, food, etc. This regular income would also help you to fulfill your dreams for your retirement life, like travelling around or adopting a new hobby.

Tax benefits – The benefit from taxes can also be received by having a retirement plan. One can have a deduction of a huge amount under Section 80C stated in the Income Tax Act of 1961. This would help a person to save for his future expenses and also lower his taxes.

Stress-free life – A retirement plan would help a person to live his life peacefully and without any stress, as proper planning for the life after retirement will help a person to get a regular income even in those days and have a stress free life. This is the main benefit of proper retirement planning that one can sit back and relax in post retirement days of his life.

Cost saving – Adopting a retirement plan at a young age helps a person to reduce the cost. For instance, the premium amount which is to be paid as stated in an insurance policy is less if the person who is in charge of the policy is young. Having insurance at the time of retirement is costly in comparison to having it in the early days of life.

Conclusion

Retirement planning is an important step when one thinks about financial needs in the future. Planning for retirement helps to get an additional income that would help to deal with financial and medical emergencies in the future. This would make a person financially independent and allow him to follow his dreams even after retirement.