Contents

Users of Accounting Information

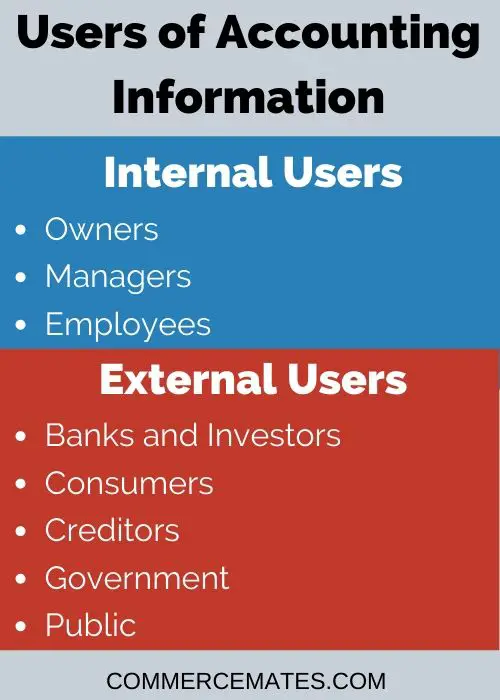

Accounting information provides the data for analysis to different users for their decisions making. These users can be owned, employees, investors, and government. Users of Accounting Information may be categorized into Internal Users and External Users.

Internal Users

Owners

Owners are the persons who invest their money and time to grow the business. They always want to know the financial position of the business and profit earned or loss suffered by the business. The financial statements provide information about the earned or loss suffered and the financial position of the business.

Managers

Managers are the person who controls the business and makes policies for the growth of the business. Managers use this information to makes plans and policies for future decisions such as setting up the sale price, cost controls, and reduction, find the problem, and take corrective measures.

Employees

Employees are interested to check the financial reports as they are working in a company. They always check the company earning and future growth so they can decide whether to join another company for their growth and job security or not.

Many employees examine accounting information in the annual report to get a better knowledge of the company’s business. Some companies also give company share to their employee which also create an interest in accounting information.

External Users

Banks and Investors

Banks and Investment are an essential part of any business as they provide loans or investment to the businesses. They watch the performance of the business to know the financial position and future projections. positive growth ensures the safety of their investment and recovery of the loan.

Consumers

Consumers do not always require accounting information but some Industrial consumers required accounting information. They buy in bulk and they make long term relationships with the suppliers. They need the information to choose the correct suppliers.

Creditors

Creditors are those people who supply goods or services on to business on credit. Creditors are interested to know about the company will be able to pay its debts or not and how much credit we can provide to the company. The financial statements help them making such decisions.

Government

The government uses financial statements to check the company is following the rules and regulations norms. The information also helps the government to take policy decisions. The government-owned Tax authorities and Tax authorities determine whether a company paying the accurate amount of tax in its tax returns.

Public

The public sometimes wants the financial information to know about the company there may be a journalist for their news or a person who wants to join the company as an employee. Researchers use accounting information in their research work.