Contents

Meaning of Corporate Tax

Income earned by a person (who comes under the threshold limit) is taxable under the Income Tax Act 1961. A person liable to pay tax has to find out the best way to make use of the deductions available to him. The planning done by the person to reduce his tax liability by making use of the allowances, deductions and other privileges available to him is known as tax planning.

Every business registered under The Companies Act, 2013 is mandatorily liable to pay the tax accrued to them. The companies have different deductions and provisions which are available to them. The process of analysing all the provisions to reduce tax liability is called Corporate Tax Planning.

Understanding Corporate tax

In simple words, corporate tax planning is the plan laid out by the companies to reduce the tax liability accrued to them by making the optimum use of the different provisions and deductions available to them. This process of tax planning is inevitable in a corporate entity. It minimises the obligation to pay tax to the government with the help of different advantages given to the corporate by the government. For those who have confusions let us make it clear. The business set up in SEZ is free from majority of the tax payable to the government. Even though they are liable to pay taxes to the government they make use of the advantage of working in the SEZ to avoid the burden of paying taxes. Did you understand the concept?

It might be a little difficult to understand the corporate measures taken by the company to reduce the tax because it is a result of continuous efforts and study that take part in the organisation.

We said corporate tax planning is an inevitable process in an organisation. Can’t a company survive without tax planning? The answer to the question is no. Tax planning is very essential to ensure the smooth working of the organisation.

Let us now look into the objectives that are behind the setting up of tax planning.

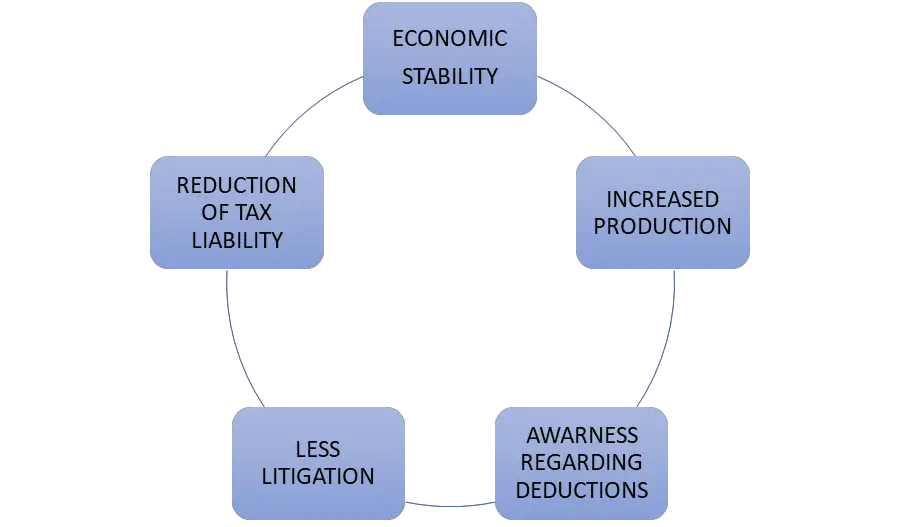

Objectives of Corporate Tax Planning

Let us now look into each objective in detail

Reduction of Tax Liability

The most important and main objective of corporate tax planning is to reduce the burden of the tax. Every corporate has some fixed amount of tax which is imposed upon them. They are inevitable. So in this case the additional taxes incurred by them need to be managed properly so that the burden can be reduced to an extent.

Economic Stability

A firm that plans its tax accordingly will have a stable economic position over other firms. We all know that corporate tax is subject to double taxation ie, the profits earned by the company are subject to tax, and this profit distributed among the stakeholders is also subject to the tax as that becomes a part of their income. So once the firm plans the tax accordingly this can be avoided to an extent by understanding the different deductions available to them and enjoying an economic privilege.

Increased Production

The firm is reducing its tax liability. The money saved by the firm can be put to other profitable and productive uses. This will in turn give rise to the optimum utilisation of the resources available to the firm.

Awareness regarding Deductions

The corporate will dig deep into the different provisions, rebates and deductions stated in favour of them in the light of tax reduction. The company will have a clear idea of the versatile options available to them and make use of them in the most efficient manner. They will be aware of these deductions only if they are keen to do tax planning in a corporation.

Minimize Litigation

The corporate even though finds ways to reduce tax corporate planning act as a standard by which this financial planning should take place. They lay out a just plan which does not break any rules of the government system that should be followed. Thus, there is a smooth link between the government and the corporate.

Planning of sales and capital

Corporate tax planning includes the proper planning of the capital that should be introduced to the business and the sales that are to achieve. There should always be a balance of both to avoid the imposition of high taxes due to high fluctuations in the business.

From the above, we can understand that corporate tax planning helps in the smooth running of the organisation. We now need to know the different types of corporate tax planning

Types of Corporate Tax Planning

Short-Range and Long-Range tax planning

Plans laid out by the corporate can differ in their nature. They may serve a single purpose or maybe they will act as a standard for the entire tenure of the organisation. If the plan is stated for a particular purpose and is usually of limited scope is called short-range tax planning. They are usually put forward at the end of the year. On the other hand, when the plan is outstretched for the whole fiscal year it is called long-range tax planning. The incidence and impact will be there for a foreseen future.

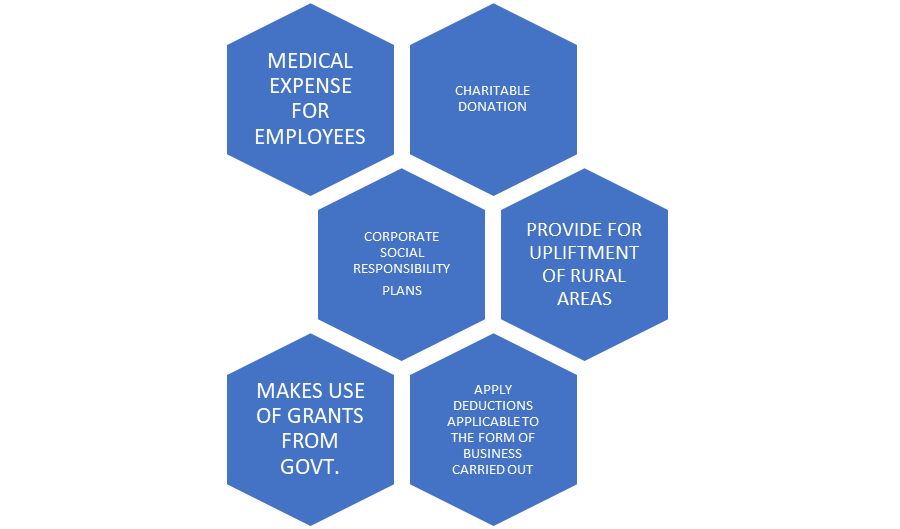

Purposive tax planning

In this the corporate tax take into consideration all the tax provisions available to them. They avail all the tax benefits and get the maximum benefit out of that. Making use of the provisions will increase the savings of the corporation.

Permissive tax planning

The organisations take into consideration the deductions and permissions given by the tax authorities to the corporation regarding limiting tax liability. They make use of all the concessions provided to them as per certain sections of the law

Advantages of Corporate Tax planning

We have discussed the different advantages of corporate tax planning in the previous headings. Let us summarise them into the following:

- Minimise the tax liability

- Increase in the use of the resources

- Increased economic stability

- Minimise litigation

- Awareness regarding provisions

- Proper maintenance of the business cycle (production process)

These are the advantage of tax planning. Doesn’t it have any limitations?

Limitations of Corporate Tax planning

The main limitations of corporate tax planning are that:

- Opting to the wrong methods for tax saving like insurance. From an individual point of view, insurance is a good option for tax savings but from a corporate point of view, it is not advisory to insure in numerous insurances for tax savings as it will not give the desired result.

- The corporate will be more focused on the optimisation of resources and maybe this will cause overproduction.

- If the deductions are not clearly understood it may result in tax evasion and result in the attraction of unwanted litigation.

Conclusion

For a corporate firm to achieve the desired success it is necessary to understand all the legal and financial aspects of the working of the business. Tax planning helps the firm to optimize its economic stability and reduce the tax burden of the corporation. All companies registered under the act would follow corporate tax planning to reduce the tax liability imposed on them. Thus we can conclude that a firm following a good systematic corporate tax planning tends to have a successful run for a foreseeable future.