Contents

What is Cost Accounting

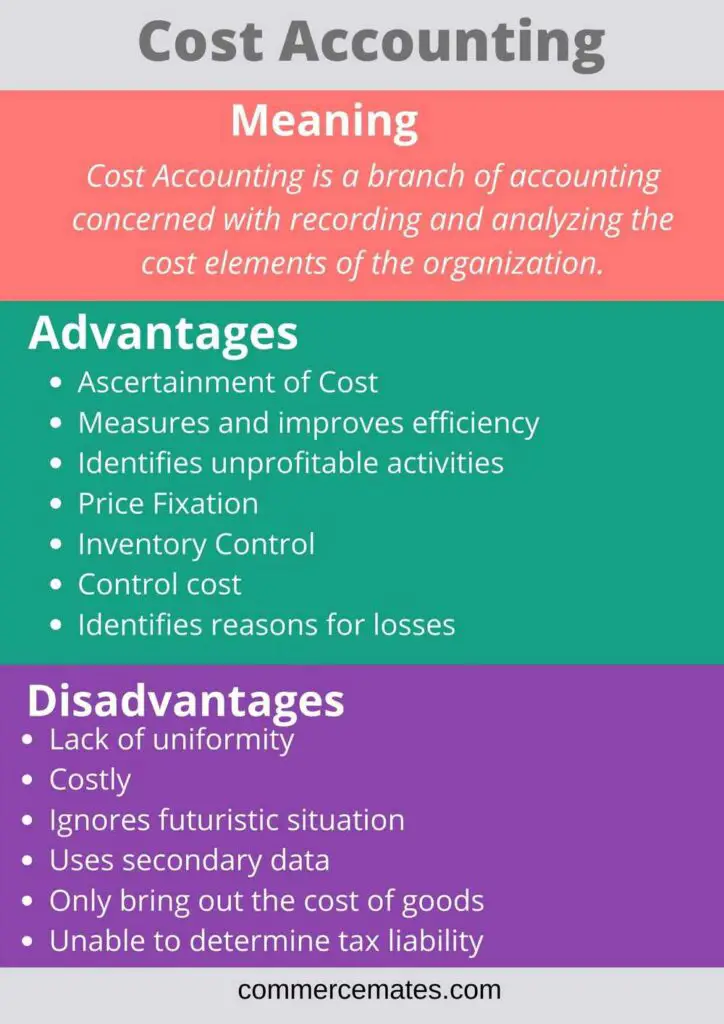

Cost accounting is a process of finding out the cost of the products or goods. Cost account helps to understand the pricing value of the products or goods.

Cost Accounting is a branch of accounting concerned with recording and analyzing the cost elements of the organization. It records each element of the company’s total cost of production including fixed cost and several variable costs involved in various stages of production. All cost elements are recorded, summarized and presented in a better way for proper understanding by the internal users of the organization.

Advantages of Cost Accounting

Ascertainment of Cost

Cost accounting serves the main purpose of ascertaining the cost of products. It records detailed information regarding all expenditures associated with production processes of business which enables manufacturers to determine the right cost.

Measures and improves efficiency

Ascertaining the performance of the organization and improving it is another important role played by cost accounting. It collects and records data with respect to cost, time and expenses. This data is used for analysis or comparison with industry which evaluates the overall efficiency.

Identifies unprofitable activities

Cost accounting assists management in determining the profitable and unprofitable activities of the business. It supplies all information regarding product cost, their selling price, and profitability of products which helps managers in choosing which products are profitable for business or not.

Price Fixation

Fixing the price of products is a crucial decision to be taken by every business. Cost accounting helps in fixing proper prices by recording and providing all information regarding the cost of production. It gives detailed information regarding all fixed and variable expenses involved in manufacturing which helps firms in fixing the right prices.

Inventory Control

Cost accounting maintains a systematic record of all stock of inventories and raw materials. It enables in avoiding overstocking or understocking like situations and helps in always maintaining an ideal stock level within the organization.

Control cost

It has an efficient role in controlling the cost of the organization. Under cost accounting, budgets are prepared and standards are fixed for each activity. No expense can go beyond the budget limit. The performance of every activity is compared with standards to find out the deviations. This will help management in exercising better control.

Identifies reasons for losses

Cost accounting evaluates and reveals the exact causes for losses suffered by the business. It evaluates the output level of every department of business and helps in finding out whether it is efficient in accordance with the capacity of the firm. Apart from the production cost and selling price, the output level also has a great influence on the profitability of the business.

Disadvantages of Cost Accounting

Lack of Uniformity

Cost Accounting has a lack of a uniform procedure. It may bring different results from the same data. So, it means that cost accounting has ineffective results.

Costly

Cost Accounting is a costly process. It requires many formalities to settle down this process and also needs lots of paper works which makes it quite costly.

Ignores Futuristic Situation

Cost Accounting ignores the futuristic situation of the product cost. It only records past cost records whereas management is taking decision regarding the future. Therefore cost data are not very useful.

Uses Secondary Data

Cost Accounting uses secondary data from financial statements for various calculations like standard cost. It does not include primary data or short term data. That’s why cost accounting does not provide effective results.

Only bring out the cost of Goods

Cost Accounting is not able to find the financial status of the company. It cannot determine the operational efficiency of a business and ascertains only the cost of goods. For assessing the financial position, we need to depend upon financial accounting.

Unable to determine tax liability

Cost Accounting cannot find out the tax liability of the company. It cannot be treated as a basis for calculating it. Financial accounting is needed for finding out the tax liability.