Contents

Meaning of Auditing

Auditing simply refers to the evaluation of business books of accounts & vouchers. It is done to make sure whether all the financial transactions are accurately recorded. Auditing aims at finding out the errors from books of accounts of the business.

It aims at the prevention of frauds. This examination is totally unbiased & conducted by an independent person. The person doing auditing should be qualified for the job to perform it with accuracy. This can be performed either by internal employees of a business or the person who are external to business.

Auditing is conducted continuously at regular intervals by the auditor. However, auditing is not mandatory for all businesses.

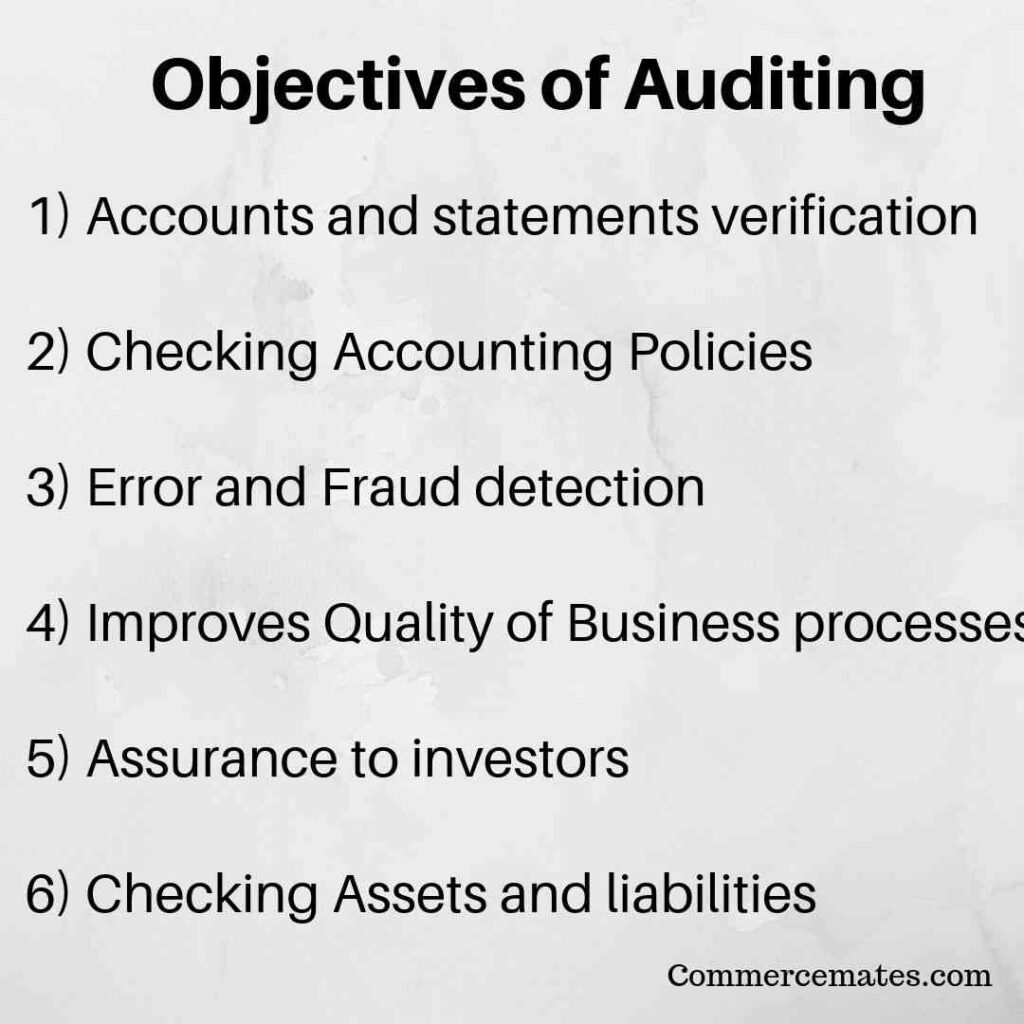

Objectives of Auditing

Accounts and statements verification

Evaluating the fairness & accuracy of books of accounts is the primary objective of Auditing. It checks each & every financial transaction thoroughly. It detects and prevents any frauds in the books of accounts. The auditor is provided with free hands to audit the books of accounts & is independent of business.

Checking Accounting Policies

Every business or organisation needs to follow some accounting policies. Books of accounts are prepared according to these accounting policies. If a business has an effective accounting system, its efficiency can be increased. It is the duty of the auditor to check the accounting policies of business & express his independent opinion.

Error and Fraud detection

Auditing helps in easy finding of errors & frauds from the books of accounts. It is the duty of management to avoid & check errors & frauds. However, sometimes it becomes difficult for management to find out the errors.

It is through auditing that helps managers to find out errors & frauds. After this managers take corrective steps against these errors or frauds.

Improves Quality of Business processes

Auditing helps management in finding out the errors & frauds. Management can take corrective measures against these errors. Steps are taken so that they are not repeated again. This way it improves the quality of business process & improves its efficiency. Also the employees of business work properly due to the threat of auditing.

Assurance to investors

Auditing assures that each & every figure represented in the financial statement is correct. It helps in evaluating every figure of business books of accounts. Financial statements after being audited are considered trustworthy by investors. Investors are fully assured by these financial statements.

Checking Assets and liabilities

Auditing thoroughly evaluates the financial statements of the business. It helps in confirming the true value of assets & liabilities of the organisation. This helps in determining true financial position of the business. After that accordingly, proper plans can be made to achieve targets & goals.

Types of Auditing

Internal Audit

An internal audit is one that is conducted within the organization by its own employees and stakeholders. It is conducted for accessing the effectiveness of internal processes, reviewing financial information, and ensuring whether a business is complying itself with proposed laws and regulations. Internal audit is termed as a first checkpoint for every organization to check the authenticity of their book of accounts, operational processes, security protocols and IT infrastructure are in line with their internal aims and external regulatory requirements.

External Audit

External audit refers to the evaluation of books of accounts by external persons that are independent of the business organization. External auditors are third parties like a charted accountant, IRS and a tax agency. These all have specialized knowledge and tasked with examination of organization’s book of accounts in compliance with (GAAS) Generally accepted auditing standards. External audit is mandatory in nature which need to be done due to shareholders requirements and regulatory reasons. It provides more transparency to business state of affairs and determine the accuracy of its accounting records. External audit is more preferred by investors and lenders for ensuring financial heath of business.

Financial Audit

It is one of the most common type of audit which are mostly done external auditors. Financial audit is also known as a statutory audit which evaluates the truth and fairness of financial statements of business organization. Every business exists to generate profits and enhance wealth of their shareholders. Financial audit enables investor and other stakeholders to ensure whether the business is going well or not so that their capital remain safe and yield expected returns. Under it, financial transactions, procedures and balances are reviewed by auditors in order to provide their credit opinion to lenders, investors and creditors.

Operational Audit

Operational audit is an internal audit performed by organization voluntarily for accessing the effectiveness of its internal operations. This audit determines whether all resources are utilized in the most efficient manner towards the achievement of organizational objectives. It monitors activities like handling of cash, materials procurement, equipment inventories and services of manpower working within the organization. Scope of operational audit is broader that encompasses everything which influence attainment of goals by business.

Compliance Audit

Compliance audit is a specific audit that is conducted to ensure whether business comply with internal and external standards. It examines the policies and procedures of business as per the requirements of prescribed laws and regulations. Compliance audit is most commonly conducted in educational institutions and regulated industries.

Tax Audit

Tax audit is one which verifies the authenticity of tax returns filed by the company. These audits are conducted by designated tax authority or government tax department. Tax auditors checks for any discrepancies in tax liabilities of business for ensuring that there is no underpay or overpay of tax amount towards the tax authorities. It evaluates for any possible errors on tax return of business.

Information System Audit

This type of audit is conducted for examining the reliability of security systems and structures. Information system audit is most important type of audit as most of the operations of organizations are today based on IT infrastructure. It ensures that accurate information is delivered by system to users and no unauthorized person have access to confidential data of organization. Information system audit may be performed as a part of internal control assessment either as a part of internal audit or external audit.

Environmental and Social Audit

Environmental and social audit is performed for assessing the footprints left by an organization on environment and society around it by doing its economic activities. The main objective of this audit is to ensure that business do not have any adverse effects on the environment.

Benefits of Auditing

Provide true and fair view

Auditing provides fair and true view of financial statements of business organization. It examines the authenticity of profit and loss account and balance sheet of business concern and identifies any discrepancies in it. This way the audited book of accounts exhibits correct picture of business conditions.

Detect errors and frauds

Auditor verifies all books of accounts maintained by business for detecting any errors and frauds. Errors are innocent mistake that occurs without any intention whereas frauds are deliberate mistakes. These both have adverse effects on organizational performance and need to be timely monitored. Process of auditing enables in overcoming these mistakes by timely detecting them and taking corrective actions accordingly.

Assist in accounts consistency

Auditing has an efficient role in maintaining the regularity of accounts in every organization. An auditor raises questions in case if accounts are not maintained consistently by business. He may give unclear auditing opinion if he found any irregularities in book of accounts. Therefore, auditing puts pressure on maintaining a consistency in book of accounts.

Independent viewpoint

Auditing provide an independent viewpoint about company’s financial statements when performed by external auditors. He inspects all accounts honestly without any hidden agenda thereby giving a fair and correct view of business position. If he declares the authenticity of book of accounts as true, it has a lot of weightage with both company and investors.

Enable in obtaining loans

Auditing ease the overall process of obtaining loans by companies. Banks and financial institutions rely on audited book of accounts for determining the true financial position of business organization. Businesses easily get approval for the loans on the basis of their audited statements of last 5 years.

Check on employees

Another important advantage provided by auditing is that it keeps a moral check on employees and other staffs working within the organization. It avoids any instance of dishonesty, irregularity and defraud on the part of employees. They all are under constant scrutiny as they are aware that all accounts will be evaluated. It eventually leads to staff being honest and responsible at all point of times.

Enhance goodwill

Auditing plays an efficient role in improving the goodwill of the organization. It reveals real profitability and financial position of business to public that creates their faith over enterprise. All stakeholders are fully assured of all audited book of accounts which results in raising the overall goodwill of organization.