Business always looks forward to multiplying the money with them. Idle money does not help to reap more profits. To increase their profit returns they turn to investments. They invest their money in different portfolios and increase their chances of reaping more profit through that investment. There are different investment portfolios available to the business. The most common portfolio used by investors to raise funds is a Structured Investment Vehicle. Structured Investment Vehicles are short-term borrowings for the purpose of investing in long-term assets.

Contents

Meaning of Structured Investment Vehicle

A structured financial vehicle is a fund that mainly invests in asset-backed securities and mortgaged-back securities and takes out credit by issuing commercial paper. The profit is earned from the difference in credit spread between short-term and long-term finance.

Special investment vehicles raise funds by borrowing from issuing commercial paper and the raised fund is invested in long-term maturity funds. They mainly generate income or profit from structured financial instruments like asset-back securities or short-term loans. By generating income from short-term loans, the investor puts himself in a position where he has a short-term liability of clearing these debts.

We mentioned earlier that a Structured Investment Vehicle is also called a conduit. SIVs are known as conduits because they are backed by commercial banks and they always invest in the major portfolios. All the trades in the SIV system are through asset-backed securities and there is higher liquidity.

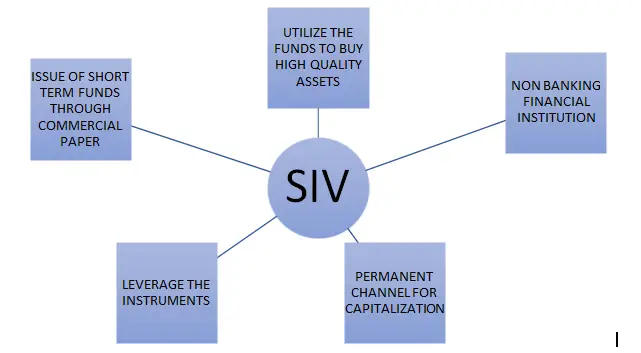

From the above chart, we can understand that SIV is a non-financial that earns profit from credit spread between short-term and long-term finance.

features of Structured Investment Vehicles

- SIV pools asset-backed securities.

- Conduit means that it is a separate business entity and assets backed are not mentioned on the balance sheet of the sponsoring company.

- Structured Investment Vehicle invests in major portfolios which include the backing of residential mortgage-backed securities.

- The asset-backed security commercial paper is issued by SIV and set up as a sponsoring institute.

- The asset-bearing commercial paper is discounted or interest-bearing.

limitations of Structured Investment Vehicles

- Asset-Backed Commercial Paper cannot be issued for more than 270 days.

- The market flexibility of the assets backed is at least every week.

- The structured investment vehicle does not possess employee credit enhancement.

- The sponsors suffer reputational risk if they do not pay the investors back on time.

Let us now look into certain examples of Structured Investment Vehicles.

Examples of Structured Investment Vehicles

The most common example of a Structured Investment Vehicle is the loan given out to mid-sized businesses in German by the IKB Deutsche Industriebank. The bank introduced a new division called Rhineland Funding Capital Corporation added to its revenue by buying bonds from the US market. These bonds were primarily invested in subprime mortgage bonds. Subprime mortgage loans were issued to the credits with lesser CIBIL scores and do not qualify for the requirements of availing of the traditional loan procedure. The bank issues commercial papers to low-profile businesses and generated revenue through that.

These types of transactions were most common because they use leverage schemes to repay the debt raised through commercial paper. The commercial paper was often reissued to repay all the liabilities that occurred through this transaction.

Structured Investment Vehicle vs Special Purpose Vehicle

To understand the exact meaning of both financial terms let us compare them on a different basis. The following table shows the same:

| BASIS OF DIFFERENCE | STRUCTURED INVESTMENT VEHICLE | SPECIAL PURPOSE VEHICLE |

| Meaning | It is a type of special-purpose vehicle that earns profit through credit spread. | This is a separate legal entity that undertakes a temporary or specified activity of the business. |

| Motive | They earn profit from the credit spread between long-term and short-term loans. They are usually asset-backed securities. | This is mainly introduced to eliminate the financial risk in various transactions undergone in an institution. |

| Scope | SIV has a narrow scope. | SPV has a wider scope. |

| Purpose | SIV protects the investor’s interest through legal protection and licensing deals | SPV restricts the firm from getting into deals with highly risky elements in the market. |

| Legality | SIV may be done to create a better reputation for the sponsor company by giving loans to companies with fewer credit ratings. | SPV cannot be introduced for any illegal activity. All activities all done for the protection of the investors against risk. |

| Example | Standard chartered investing in Whistlejacket structured investment vehicle | ENRON created SPV to overcome the debts incurred by them. |

Conclusion

Structured Investment Vehicles invest in assets and pay off the short-term loans of the firm mainly through commercial paper. All the transactions are usually taking place in the money market. These are usually asset-backed commercial paper transactions. A profit is earned by the firm through the difference between the long-term loan availed and the short-term debt of the company. the assets backed commercial papers are usually reissued to pay off debt and make use of the leverage policy of the financial institution. Special Purpose Vehicles are a separate legal existence that helps to eliminate the financial risk in the different transactions. These are usually concerned with the protection of the sponsor company and the company issues SPV to overcome these debts occurring in the transaction market of the firm.