Contents

What is the Financial System?

A financial system may be defined as a set of institutions, instruments, and markets which promote savings and channels them to their most efficient use. It consists of individuals (savers), intermediaries, markets and users of savings (investors).

- financial system definition by authors

According to Prasanna Chandra,

“financial system consists of a variety of institutions, markets, and instruments related in a systematic manner and provide the principal means by which savings are transformed into

investments”.

According to Van Horne,

“financial system allocates savings efficiently in an economy to ultimate users either for investment in real assets or for consumption”.

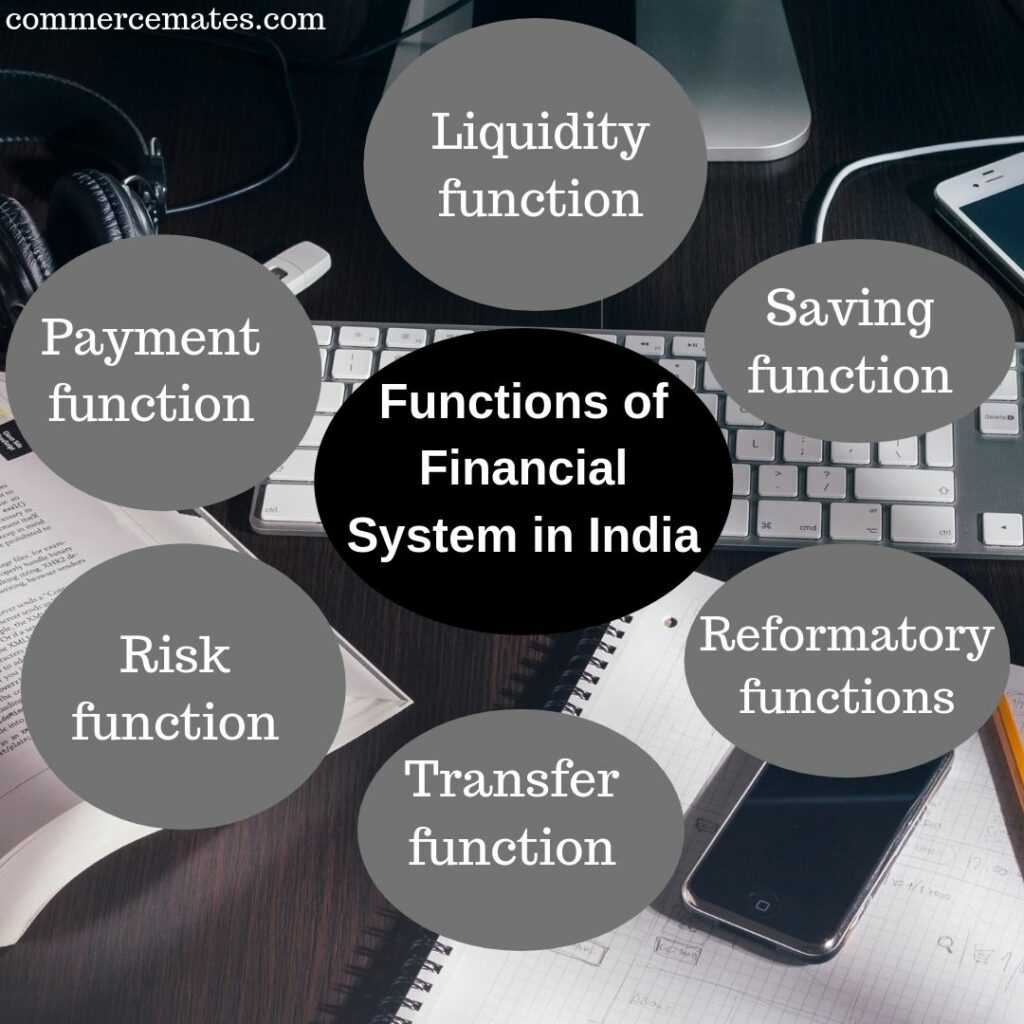

Functions of Financial System in India

Liquidity function

The most important function of a financial system is to provide money and monetary assets for the production of goods and services. Monetary assets are those assets that can be converted into cash or money easily without loss of value. All activities in a financial system are related to the liquidity-either provision of liquidity or trading in liquidity.

Payment function

The financial system offers a very convenient mode of payment for goods and services. The cheque system and credit card system are the easiest methods of payment in the economy. The cost and time of transactions are considerably reduced.

Saving function

An important function of a financial system is to mobilize savings and channelize them into productive activities. It is through the financial system the savings are transformed into investments.

Risk function

The financial markets provide protection against life, health, and income risks. These guarantees are accomplished through the sale of life, health insurance, and property insurance policies.

Transfer function

A financial system provides a mechanism for the transfer of resources across geographic boundaries.

Reformatory functions

A financial system undertaking the functions of developing, introducing innovative financial assets/instruments services and practices and restructuring the existing assets, services, etc, to cater to the emerging needs of borrowers and investors.

Objectives of Financial System

Facilitate Payment

The financial system facilitates payment through banks and any other financial institution. Anything we buy or sale requires the transection of money. That is done by the financial system

It Link Between Saver and Investor

The financial system provides a place where saver and investor meets. Saver saves money and investors invest it in different types of stocks to get profit on it.

Helps in Capital Formation

For capital formation, there should be a good financial system that provides the finance timely and in an appropriate amount.

To ensure Safety on Investment

The financial system has different institutions for the proper supervision of the financial market that controls the market. So, the safety of the investment can be done.

Helps in the growth of the economy

Proper mobilization of funds and proper control in the financial market helps the business to grow and motivate investors to invest. That helps in the growth of the economy.