Contents

Meaning of Financial Accounting

Financial accounting is a branch of accounting that records each financial information and analyzes it to determine the financial position of the business. It is a process of recording, summarizing, analyzing and presentation of all financial transactions of business in the form of financial statements. Financial accounting involves the preparation of various financial statements like income statement, cash flow statement, balance sheet, etc. using accounting principles. These financial statements are prepared on a routine basis by companies and presented to all its stakeholders.

Financial accounting aims at delivering a fair and accurate image of financial affairs of business to all its stakeholders. It is done in accordance with rules provided by GAAP or IFRS. It is an important tool for management in their decision making as they depend on financial reports for decision taking and forecasting purposes.

Financial statements prepared by financial accounting takes into account the following aspects of business viz. Expenses, Revenue, Asset, Equity, and Liability. Financial accounting has an important role in increasing profitability and efficiency as it helps in managing all financial resources of the business. It is statutorily required to practice financial accounting in their operations by every business organization.

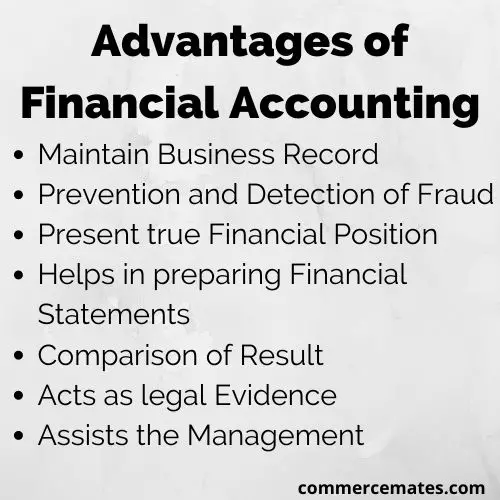

Advantages of Financial Accounting

Maintain Business Record

Financial accounting records each and every transaction of business organization. It systematically maintains a proper book of accounts of all monetary transactions. Unlike human memory which has a limited capacity to remember things, financial accounting can record large amounts of transactions.

Prevention and Detection of Fraud

Avoidance and detection of frauds or errors is important role played by financial accounting. It records all financial data fairly which is used by management for analysis purposes. This data acts as proof and reduces the chances of any frauds or errors.

Present true Financial Position

Financial accounting reveals and interprets the true financial position of organizations. It records each financial aspect and supplies it from time to time to the internal management team. Managers get the real ideas of all financial resources of the organization regularly through data supplied by financial accounting. It helps them in making proper decisions for managing the overall financial position.

Helps in preparing Financial Statements

Preparation of financial statements is a must for knowing the true profit or loss and real worth of the organization. Financial accounting supplies all relevant accounting data for the preparation of financial statements like profit and loss account and balance sheet.

Comparison of Result

Financial accounting helps in comparing the performance of business organizations. It systematically records and stores financial data for many accounting years. This way comparison of present data with previous year’s data can be easily done.

Acts as legal Evidence

Financial accounting serves as legal evidence of all data and helps in settling of all business disputes. It prepares and maintains systematic books of accounts of all financial transactions which can be used for avoiding any confusion or misunderstanding.

Assists the Management

Managers depends on financial accounting for various data for taking managerial decisions. It provides the full information’s regarding all cash flows in an organization. They can easily anticipate any surplus or deficit of funds in an organization and take decisions accordingly.

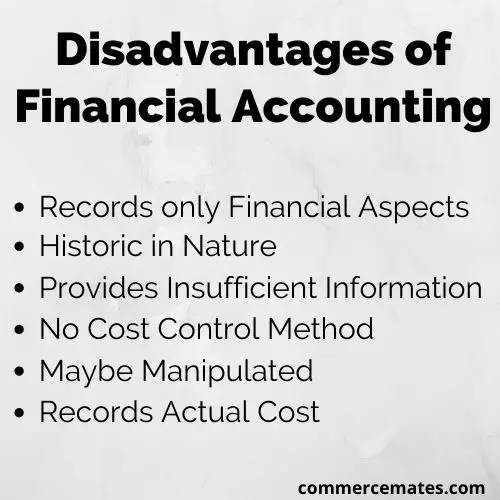

Disadvantages of Financial Accounting

Records only Financial Aspects

The foremost disadvantage of financial accounting is that it considers only monetary transactions of organizations. It does not take into account various non-financial aspects such as market competition, economic conditions, political situation, government rules, and regulations, etc. All these factors have a great influence on the functioning of organizations.

Historic in Nature

Financial accounting provides all historical data from past activities. It does not provide data on day-to-day activities rather than it accumulates all accounting information of a particular accounting period at the end of that period. All financial decisions of the future are taken on the basis of this past information whereas historic data may not be always appropriate for predicting future activities.

Provides Insufficient Information

Financial accounting does not provide detailed information related to departments, products, processes, service or any other activity within the organization. It presents data as a whole in terms of assets, liabilities, profit, and loss of organization. Separate data related to specific activities are not presented which may be required by management for decision making.

No Cost Control Method

It does not have any role in controlling the cost or expenses of organization. Financial accounting provides cost data at end of accounting period means when they are already incurred. It also does not check any wastage or losses of materials and misappropriation. Financial accounting has nothing to do with controlling the cost.

Maybe Manipulated

Information presented by financial accounting may be manipulated as per the desire of management. They may change the figures and present misappropriated data for their interest. Profit may be shown high by them to attract equity shareholders or they may reduce it to evade tax.

Records Actual Cost

Financial accounting does not consider the price fluctuations taking place from time to time. It records the historical cost or the actual cost of the acquisition of assets. The value of the asset does not remain the same and it changes with time. Financial accounting in this way may present inaccurate information.