Contents

Meaning of Employee Stock Option Plan

An employee stock option plan is a benefit provided to an employee by an employer by offering him the stock or shares of the company at a price lower than the market price. It is done by an employer to retain the employee in the company for a longer period than usual.

In an ESOP, an employer decides to offer the stocks of a company to a permanent employee, any member who is a promoter, whole-time director, or part-time director. The employer decides the terms and conditions of the ESOP, such as the number of shares, the period for which it is granted, and share prices. Afterward, it is offered to the employee, including a vesting period that reflects the time limit during which the employee has to work in the company to avail himself of the benefits of ESOP. If the employee leaves the company before this vesting period, he loses his rights to the ESOP.

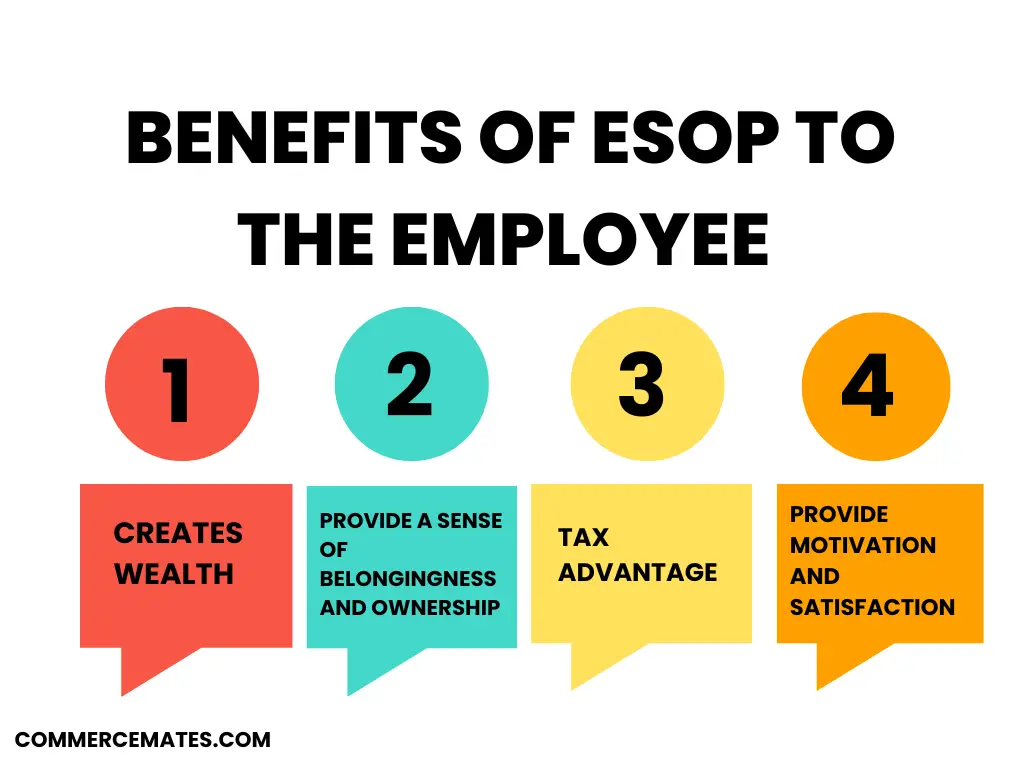

Benefits of ESOP to the employee

Creates wealth for the employee

Equity is considered the most viable option to create wealth or to invest money in the long run. An ESOP allows an employee to purchase a company’s stock at a lower price than the market price. Apart from this, it increases the wealth creation capacity of an employee and builds exposure to personal finance and the stock market. Just like a bonus or other financial incentives, ESOP aids personal finance and provides long-term benefits.

Provided a sense of belongingness and ownership

ESOP develops a sense of belongingness and ownership in the employee. This is because the more you put your efforts into achieving the goals of the company, the more it will help you appreciate the value of your equity or the company’s equity. The company’s share, objectives, and goals are directly proportional to your wealth, income, and finances.

Tax advantage

ESOP is a tax exempted scheme. Tax is not charged on the contribution made or received by an employee in the ESOP. Tax is only charged when the employee withdraws money after retirement.

Provides motivation and satisfaction

The ESOP motivates the employee to work harder as their hard work directly leads to an increase in the company’s share price and wealth. It provides a sense of satisfaction to the employee that all their hard work and efforts are going to benefit them in securing a better future. When they retire, they will have sufficient financial aid from their ESOP.

Benefits of ESOP to the employer

Retain the talented employee

ESOP helps retain talented employees within the organization. This is because ESOP is created with a time limit, upon completion of which only the employee can avail himself of all the financial benefits arising from ESOP. So, the employee is bound by the time limit and stays with the company.

Increases the productivity

As an increase in the company’s share directly benefits the employee through ESOP, the employee works harder, and the company’s productivity increases at a fast pace. Through ESOP, the overall performance of the company increased and continued to improve day by day.

Tax exemption

ESOP structures provide tax exemption not only to the employee but to the employer as well. The contribution made to the ESOP scheme is tax deductible. The employee has to pay the tax when they retrieve the money from their ESOP. So, employers are relaxed about paying taxes on the ESOP.

Reduces the cost of recruitment

ESOP not only enables the retention of the employee in the company but also leads to a decrease in the cost of recruitment. The company can thereby utilize the recruitment cost for other purposes. This further enables a company to reach its target faster than usual.

Provide greater opportunities for retirement

With the help of an ESOP scheme, employees, directors, shareholders, and other older members can take retirement as and when required. They do not have to worry about the functioning of the company, as the employee under the ESOP scheme can take over the work easily. There will be no disruption or dilution of management or the company’s ownership.