Every organization has different departments through which work takes place. There are numerous transactions through different departments on daily basis. Recording these transactions in total will be clumsy and confusing. The efficiency of each department cannot be identified and in the case of malpractices, they cannot be identified. To avoid these, certain measures are adopted. Departmental accounting is the most efficient and commonly used practice in all organizations.

Let us look into what is meant by departmental accounting.

Contents

Meaning Of Departmental Accounting

Departmental accounts refer to maintaining books of accounts to ascertain the efficiency of every departmental activity that is undertaken in an organization. An organization which works through different departments maintains all books of records to understand the financial capability of the particular department and its contribution to the organization.

The main objectives of departmental accounting are:

- There is a clear-cut idea of what is going on in each department

- The efficiency and the drawbacks of each department are pointed out separately and remedies can be taken at that very moment.

- There is an opportunity to understand which department provides the maximum income for the organization

- There is a provision for comparison among the different departments of the organization.

- There will be a well-defined policy plan according to the requirements of the particular department.

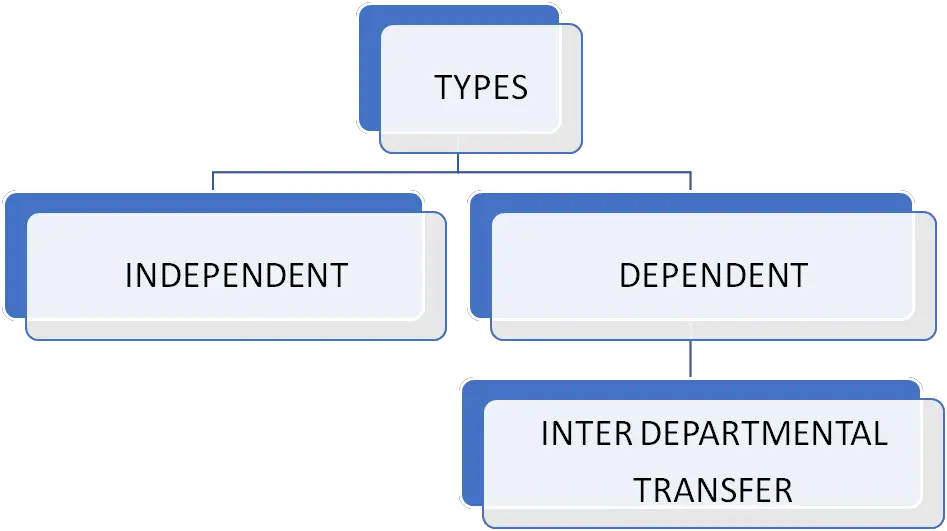

Types Of Departmental Accounting

All departments are of different natures. They can have different priorities as per their requirements. There are different kinds of the department according to their nature.

Independent department

As the name suggests it is not related to any other department. It works independently. The workings of this department are completely isolated and independent from all the other departments. For example, the legal department of an organization works independently. They are not influenced by any other departments in the organization.

Dependent department

The operations of this department will be influenced by other departments in the organisation. There will be the transfer of goods from one department to another department in these types of the department. In certain cases, the output of one department will be the input of another department. The transfer of goods from one department to another department is known as Inter-Departmental Transfer.

Let us now look into what is the true meaning of inter-departmental transfer and its application

Inter-Departmental transfer

When the goods are transferred among different departments the cost of these transfers is to be recorded separately. The price at which the transfer is done is called the transfer price. The transfer may be done according to a pre-determined selling price or at cost. They can be done based on cost, market price or cost-plus agreed percentage of profit.

There can be an unrealized profit which arises due to the unsold inventory in the stock room. This arises when the transfer is done at market price or cost plus the agreed percentage of profit. This unrealized profit is to be eliminated before the preparation of the balance sheet. This elimination is done with the help of creating a stock reserve at the end of the accounting year to calculate the unsold inventory in the department. The amount of stock reserve is calculated by

= Transfer price of unsold Stock x Profit included in transfer price Transfer Price

Let us understand this concept with a simple example:

Certain goods are transferred from Department X to Department Y at a price 50% above cost. If the closing stock of Department Y is 30000, compute the amount of stock reserve.

Dept X transfers goods to Dept Y at a profit of 50% of the cost.

If cost=100 transfer price is 150 [100+(100*50%)]

Stock reserve = 30000×50/150

=10000

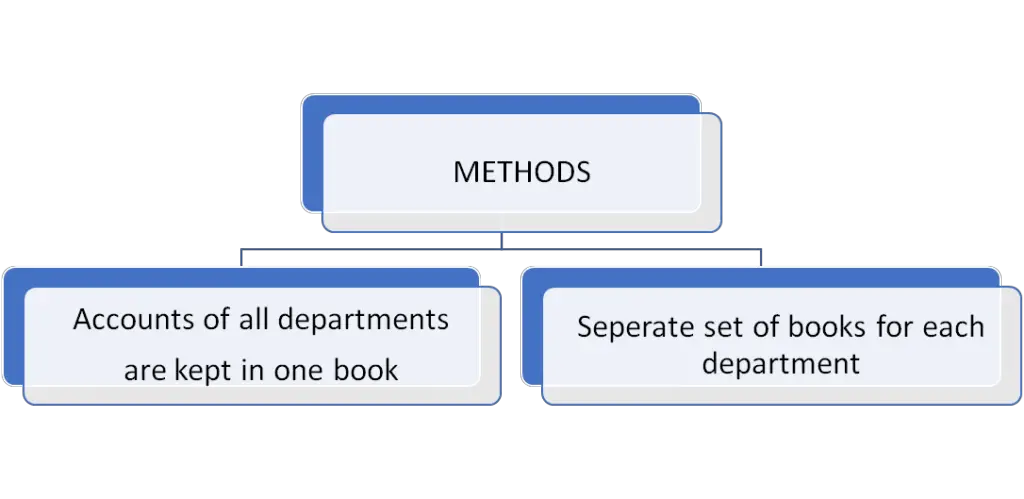

Now we know the basic calculations which are done in departmental accounting. But have you wondered how departmental accounting is done? Whether there is a standard procedure that is to be followed to prepare the departmental accounts of a firm. We are going to discuss the methods of departmental accounts next.

Methods Of Departmental Accounting

From the above chart, it is clear that there are mainly 2 methods.

Accounts under one book

The first method is where there is a common book for all the departments of the organization. There will be individual columns for each department in the single book. This is most suitable in smaller organisations where the number of departments is limited. The accounts are maintained on a columnar basis. Separate columns are maintained in the accounting books for sales, purchases, stock expenses, etc. The classification may be done either product-wise (like in the sales book) or function-wise (according to the function they undertake).

Separate books for each department

This is mainly done in large organisations where a columnar basis is difficult to follow. There will be numerous departments in one single firm and accounting for all these departments in a single book is very difficult. The number of columns will be larger in number. So to avoid these separate books are maintained to record the transactions occurring in each department. This is an expensive method compared to the columnar method. The common expenses incurred are to be allocated to the different departments of the organization.

Allocation Of The Expenses

There are mainly 2 types of expenses that are incurred by a department.

Individually identifiable expenses:

These expenses are incurred in a particular department and apply only to that department. They are directly recorded in the books which are maintained by them.

Common expenses:

These expenses are incurred commonly by all the departments. The benefit is enjoyed by all the departments of the organization. As all the departments benefit from this expense it should be divided on an equitable basis.

Some commonly occurred expenses and their allocation is stated below:

| EXPENSES | ALLOCATION |

| Carriage Inward Discount Received | Purchase of each department |

| Selling expenses, Discount Bad Debts Selling Commission Freight Outward Sales Manager’s Salary Travelling expenses | Sale of each department |

| Rent, Rates and Taxes, Repairs and Maintenance Insurance of Building | If given that ratio is considered (floor area occupancy ratio) or according to time |

| Lighting Expense Heating Expenses | Based on energy consumed |

| Employee/worker Insurance | According to direct wages expenses of each department |

| Wages/Salaries Administrative and Other Expenses Salaries of Managers, Directors Common Advertisement Expenses | According to the time spent or equitably. |

| Depreciation Insurance Repairs and Maintenance of capital assets | Value of the assets of each department |

These are some of the most commonly occurring transactions in an organization.

Let us now see an illustration with the application of what we have learnt so far.

From the following information given below prepare the Departmental Trading and Profit and Loss Account for the year ended 31.3.2020 of M/s Achira & Company where department X sells goods to department Y at the Normal selling price.

Individual expenses:

| Expenses | DEPT X | DEPT Y |

| Opening stock | 175000 | – |

| Purchases | 402000 | 35000 |

| Inter Transfer of Goods | – | 1225000 |

| Wages | 17000 | 28000 |

| Electricity Expenses | 17500 | 245000 |

| Closing Stock (at cost) | 855000 | 305000 |

| Sales | 402000 | 2750000 |

| Office Expenses | 35000 | 30000 |

Combined expenses:

Salaries (2:1 Ratio) 472800

Printing and Stationery Expenses (3:1 Ratio) 157500

Advertisement Expenses (Sale Ratio) 1400000

Depreciation (1:3 Ratio) 25000

This is a basic illustration where there are not many complications.

Let us see how the accounts would look under departmental accounting.

Books of accounts of M/s Achira & Company:

Trading and Profit and loss account for the year ended

31.3.2020

Dr Cr

| PARTICULARS | DEPT X | DEPT Y | PARTICULARS | DEPT X | DEPT Y |

| To opening stock | 175000 | By Sales | 402000 | 2750000 | |

| To purchases | 402000 | 35000 | By transferring to B | 1225000 | |

| To transfer from Y | 1225000 | By closing stock | 855000 | 305000 | |

| To wages | 17000 | 28000 | |||

| To Gross Profit c/d | 1888000 | 1767000 | |||

| 2482000 | 3055000 | 2482000 | 3055000 |

| To Electricity Expenses | 17500 | 24500 | By Gross Profit b/d | 1888000 | 1767000 |

| To Office Expenses | 35000 | 30000 | |||

| To Salaries (2:1) | 315000 | 157600 | |||

| To Printing & stationery | 118125 | 39375 | |||

| To Advertisement Exp. | 178554 | 1221446 | |||

| To Depreciation (1:3 Ratio) | 6250 | 18750 | |||

| NET PROFIT | 1217571 | 275329 | |||

| 1888000 | 1767000 | 1888000 | 1767000 |

From the above illustration, the concept of departmental accounting will be clear.

Conclusion

In the above article, we can clearly understand the concept of departmental accounting. It is understandable that in any organisation which follows departmental accounting their accounts will be clear-cut and more precise. We can conclude that if an organisation, irrespective of the size, follows departmental accounting the accounts will be more clear. Through departmental accounting, the clear track of records of the transactions of each department can be clearly understood.