In this fast-growing world, the portfolio is taking on an important role in the market. The portfolio is a collection of financial assets such as stocks, bonds, cash, cash equivalents, etc, that are held by an investor or an individual. A portfolio is divided into small segments that represent the wide variety of assets or investments held by an investor.

An investor usually invests in different types of assets in the portfolio as well. This is done to increase the earning capacity of the investor, as the investment in the portfolio will yield a high return in a future period. But, due to a large number of portfolios available on the market, it is difficult for an investor to determine which portfolio is more profitable or not. So, to overcome this type of confusion, there is the concept of portfolio optimization.

Contents

What is Portfolio Optimization?

Portfolio optimization is the process of selecting the best portfolio from a given set of valuable portfolios. In other words, it is the process by which investors examine, out of the available portfolios, which portfolio will provide them with the maximum return. It is done by using different methods and tools. These tools or methods help to anticipate the future earnings from a particular asset in comparison to others. Thereby making the investment decision fruitful and easy.

Portfolio optimization is important for an investor to minimize financial risk and maximize financial return. It is based on modern portfolio theory.

Modern Portfolio Theory

In 1952, Harry Markowitz, an American economist, developed the concept of modern portfolio theory. In this concept, he explains that; an investor always wants to maximize his expected return while taking a certain risk for it. He further explains that the portfolios which satisfy these criteria of an investor are efficient, as they are giving a higher expected return on more risk.

He marked this risk-expected return theory as the efficient frontier. Further, he argues that each portfolio, which is an efficient frontier is well diversified.

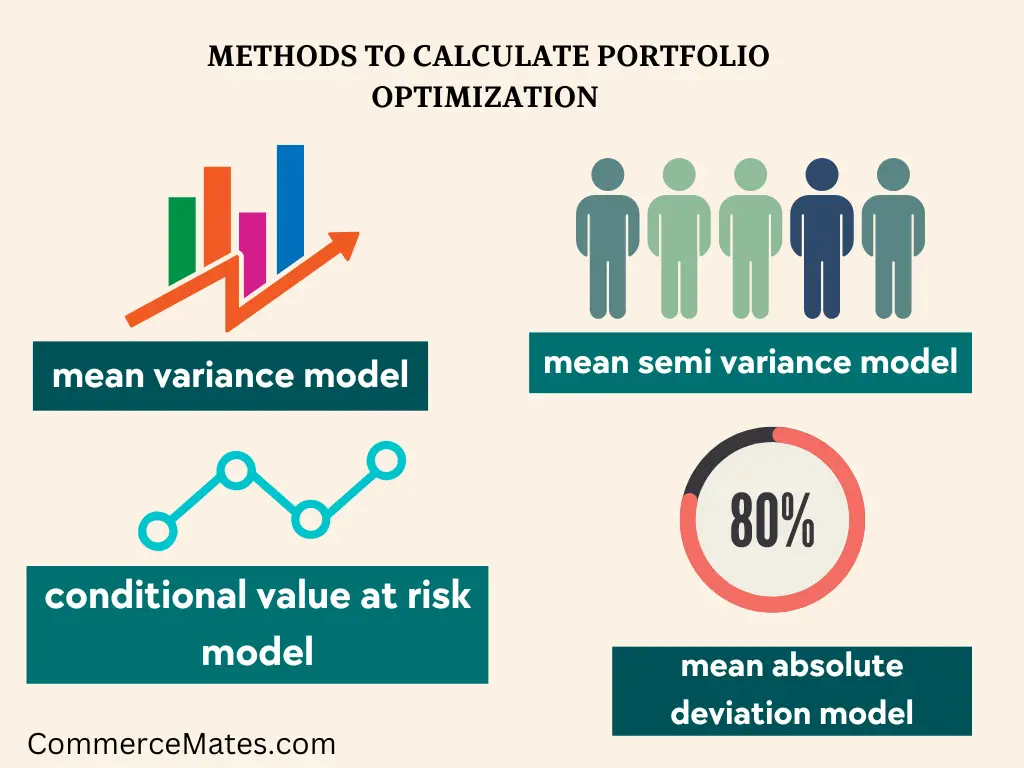

Methods to Calculate Portfolio Optimization

There are various methods to calculate portfolio optimization. Some of them are given below.

Mean-variance model

In this model, the investor tries to spread the risk of investment across their portfolios. In this method, the investor measures the “variance,” which is an asset’s risk, then compares it with the return the asset is likely to yield. This method is done to maximize the return accruing from a highly risky investment.

Mean semi-variance model

The principle guiding mean semi-variance model is the same as the mean-variance model. In this also, the investor tries to minimize the risk up to a certain level while keeping the return at a high level. However, it is more suitable in situations where asset returns are not symmetrically distributed.

Conditional value at risk model

This method is derived from the value of an investment or portfolio at risk. It is calculated by deriving a weighted average of all the extreme losses in the distribution of possible returns beyond the value at the risk cutoff point.

Mean absolute deviation model

The mean absolute deviation model is used to achieve the set or targeted rate of return or to minimize the risk. It is calculated by taking a measure of the average absolute distance between each data value and the mean of a data set of the portfolios.

Process of Portfolio Optimization

Portfolio optimization is a two-part process:

Selecting the asset classes

The first step in portfolio optimization is to select the asset classes. Asset classes include equities, bonds, gold, and real states. These classes are identified by the investors and then they decided in which class they want to allocate the funds. Afterward, an investor decides the weight of every class of asset to make a wise choice.

Selecting assets within a class

After deciding the asset class, the investors have to decide which asset and in what amount, he wants to include in their portfolio. For this purpose, the investor estimates the risk-return factor of the assets to include the most profitable asset in the portfolio.