Contents

Principles of Investment : Meaning

Investing, in general, is putting money to work in some sort of project or undertaking for a set period to generate positive returns (i.e., profits that exceed the amount of the initial investment). It is the act of allocating resources, typically capital (money), with the expectation of generating income, profit, or gains.

One can invest in a variety of endeavors (directly or indirectly), such as using money to start a business or purchasing real estate in the hopes of generating rental income and/or reselling it later at a higher price.

In contrast to saving, investing involves putting money to work, which carries an implied risk that the connected project(s) could fail and cause a financial loss. The other way that investing differs from speculation is that the latter involves betting on short-term price swings rather than putting the capital to work.

Understanding Principles of Investment

An investor’s decision-making process is governed by a set of beliefs and principles known as an investment philosophy. It is more of a set of principles and tactics that take into account one’s objectives, level of risk tolerance, time frame, and expectations rather than a strict set of laws or regulations. Thus, a compatible investing philosophy and style typically go hand in hand.

Value investing, which concentrates on stocks that the investor believes are fundamentally underpriced, growth investing, which targets businesses that are growing or expanding, and investing in assets that provide interest income are some common investment theories. Other investment theories include technical and fundamental analysis.

Types of Investment Principles

Investment philosophies should take into account the investor’s goals, timeline or horizon, tolerance for various types of risks, and individual capital status or needs. The following are some common investment approaches:

- Value investing entails purchasing undervalued equities in the hopes that their value will increase dramatically.

- Finding businesses with promising profit outlooks is the cornerstone of fundamental analysis.

- Growth investing: To profit from rising stock prices, growth investors purchase shares of younger companies that are achieving above-average growth in sales and earnings.

- The goal of socially responsible investing (SRI) is to make investments in businesses whose activities reflect the investor’s ideals regarding the company’s effects on the community and the environment. Sometimes, SRI is referred to as ESG investing.

- Technical analysis uses historical market data to find distinctive visual patterns in trading activity as the foundation for buying and selling choices

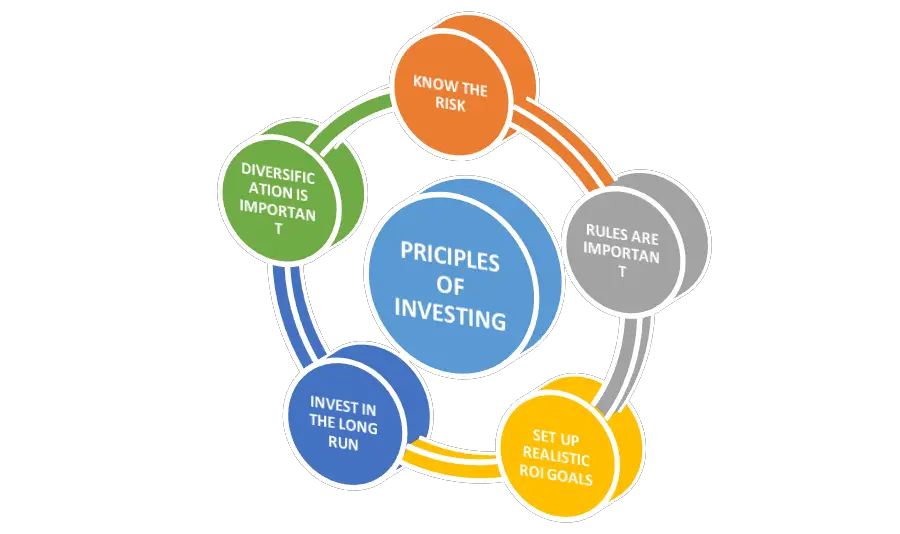

Principles of Investing

Unfortunately, if you want to reduce your risks and increase your chances of a strong ROI, you have to start someplace and carefully develop your investments. A well-defined, adequately maintained financial portfolio doesn’t magically appear overnight. These five investment tenets are important to keep in mind whether you’re managing your portfolio or employing a private company to do it for you. These are just the fundamental principles of investing; they are not suggestions on how to invest your money.

Know the risk

There is no such thing as a risk-free investment, which is what makes stock market investing so difficult. Every investor should be able to identify and mitigate risk in their investments, as well as invest by their risk tolerance.

Because of the risk involved in the process, investing your money can be a rewarding experience. In general, the greater the risk, the greater the reward. However, what is acceptable to one person may not be acceptable to another. While investing your money may seem intimidating, you don’t have to manage your portfolio yourself if you understand the risks involved. Instead, you can hire a portfolio manager to do the legwork for you.

Rules are important

If you want to manage your portfolio, the best results usually come when the investor follows a strict set of rules. Wishy-washy rules like “A portion of my investment should be real estate” and “I’ll consider selling if the value begins to fall” are insufficient – Set specific values for how much of your portfolio should be allocated to each investment, as well as rules for when you want to sell.

However, due to the time, knowledge, and skill required to do this successfully, many people prefer to use a discretionary investment management firm instead. Your portfolio manager will still adhere to strict guidelines regarding your investment mandate. Individual investments will be bought and sold entirely at the discretion of the portfolio manager.

Set up realistic Return On Investment (ROI) goals

Everyone strives for the biggest ROI at the lowest risk. Unfortunately, little risk and return are inversely correlated. You’re going to be let down if you’re seeking secure investments that promise a return of 12 percent or more because there aren’t any of those. Don’t expect a significant return on investment (ROI) unless you just want safe assets.

The return on investments is a crucial presumption to make when setting financial goals. This is because having irrational expectations can ruin your finances. Let’s say you want to save Rs. 10 lakh over the next ten years and anticipate an annual return of 20%. Based on this supposition, you will need to put aside Rs 2,615 per month for ten years. What happens if your portfolio only earns 12% annually? You will fall 4 lakh rupees short of the goal. You may be left helpless by such a sizable deficit.

Diversification is important

To reduce market volatility, diversification includes distributing your investing funds among various asset classes. You might be more likely to keep a long-term portfolio position by “smoothing out” market performance, which could increase your chances of achieving important investment objectives.

Small-scale investment diversification has huge advantages. In other words, five investments are significantly superior to two, and ten investments are superior to five. However, as the numbers increase, the marginal benefits of making additional investments decline until the costs outweigh the advantages.

As an example, all equity (or stock) investments and the majority of fixed-income (or bond) investments are subject to market volatility. Short-term volatility is usually reduced by holding a mix of stocks and bonds. Bonds may perform better during periods when stocks are struggling, helping to offset the negative returns in stocks. At times, stocks may outperform bonds significantly.

Invest in the Long Run

Short-term investing is one of the most serious flaws in today’s investment strategies. Truly great investors understand that if you buy an investment at a low price, it may take some time for the market to recognize its true worth. Because short-term trading usually results in poor long-term performance, long-term investing is one of the most important investing principles. This is common because many investors allow fear and greed to drive their decisions. If you make wise investment decisions, the long term will take care of itself.

As a result, you should be ready to capitalize on investment opportunities. Simultaneously, you must be aware of overvalued assets and be willing to convert them to cash when conditions are unfavorable.